April 2020 – Covid-19 Legal Update Archive

- April 1, 2020: PPP Guidance, SBA Updates & Some Humor

- April 2, 2020: COVID-19 Loan Program Updates

- April 2, 2020: Interim Final Rule for PPP issued

- April 3, 2020: PPP Application Submissions….its kind of like Black Friday Shopping…but this is actually serious!

- April 5, 2020: Covid-19 Disaster Funding Programs – If you stare long enough, you will see a sailboat

- April 6, 2020: More PPP info (or confusion) & Lunchspirations Podcast Registration

- April 7, 2020: When will this be over? PPP FAQ

- April 8, 2020: COVID Business Law Update: If you are going through hell, keep going

- April 9, 2020: Christian Miller’s COVID-19 Legal Updates for April 9th

- April 9, 2020: Schools out, at least for this year – Keep Moving Forward

- April 10, 2020: Top Ten EIDL and PPP Questions

- April 13, 2020: MPL General Counsel Corner – Another day closer

- April 15, 2020: MPL General Counsel Corner – Let’s Hope These Aren’t Meetings About Meeting

- April 16, 2020: Attorney Christian Miller: COVID-19 Update

- April 16, 2020: MPL General Counsel Corner – Going, Going….Gone (Maybe?)

- April 17, 2020: No more PPP, No More EIDL, Now What?

- April 19, 2020: You Don’t Have to Participate in A Downturn

- April 20, 2020: Race to open….kind of

- April 21, 2020: MPL General Counsel Corner – Why are we waiting?

- April 22, 2020: Crickets from DC, but Fireworks Likely in Harrisburg

- April 23, 2020: No word yet from DC

- April 24, 2020: General Counsel Corner – PPP: Think Before You Apply

- April 26, 2020: MPL General Counsel Corner – An Attorney That Represents Himself Has A Fool for A Client

- April 27, 2020: MPL General Counsel Corner – And They Are Off And Running

- April 28, 2020: MPL General Counsel Corner – I’m from the government and I’m here to help…unless you don’t need the money

- April 29, 2020: MPL General Counsel Corner – Another day, a few more updates

- April 30, 2020: MPL General Counsel Corner ….and now on the first tee

April 1, 2020: PPP Guidance, SBA Updates & Some Humor

Given its April Fool’s Day, I was going to have the following headline: “Coronavirus defeated, all social distancing rules lifted.” However, in the current environment, I will reserve my humor for other topics (see the end of the email).

It is definitely a weird time. I was chatting with a friend/business coach/Vistage Chair (Chad Harvey; www.chadharvey.com) yesterday. He said it best: “Every day, I feel like I have worked harder than I have before only to complete at best half of what I planned to do”……Wise words that sum up my daily work routine as well.

Here are the things that I think are important and you may want to review:

- PPP guidance provided, sample application linked here. The much-anticipated guidance on PPP was released by the SBA and the Department of Treasury. Loans can start to be processed in April. As a reminder, this guidance and the program are being updated almost daily. Please make sure you review your options with your Bank. The King of Prussia SBA Office provided the following guidance last night:

“SBA will be providing more guidance to lenders shortly which will be provided through their respective banking and trade associations. This will happen in the next 24 hours. So what can you do?

- Familiarize yourself with the (current version) of the PPP application – linked above

- Start to gather any information you have which may justify their payroll/loan amount calculation (official guidance is forthcoming).

- Once we receive word from the SBA on any other required documentation, we will let you know.”

- Linked is a list of SBA lenders and consultants (not exhaustive, but a good start….if you are not on the list, please send me your details)

- SBA and other COVID-19 Disaster Loans; Things You Should Consider If You Have Preexisting Loans: As you are applying for the various programs, please make sure you are reviewing any of your preexisting loan documents and talking with your legal counsel, accountant, banker or other professional service provider. Also, the linked document provides a good comparison of PPP and EIDL. Below are some questions to consider:

- What are the recourse provisions (e.g., personal guarantees)?

- What impact will the new SBA loan have on existing collateral?

- Are there any cross default issues?

- Are there any non-monetary default provisions?

- What happens if you file for bankruptcy or close the business?

- Will the bank take a second position to the new SBA loan?

PLEASE LET US KNOW IF YOU WOULD LIKE TO DISCUSS ANY OF THE TOPICS ABOVE

- PA Working Capital Assistance Program has been exhausted; Nothing definitive as a follow on, but more could be proposed.

- Upcoming Webinars

- RKL Webinar 4/3/2020 @ 11am

- EisnerAmper 4/2/2020 1:30pm-3pm

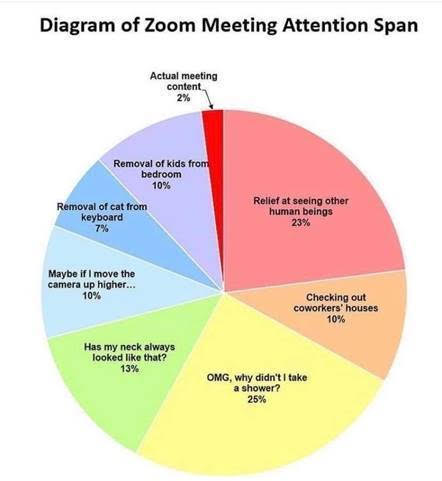

And last but not least, we did an informal survey of ZOOM users and their meeting usage time. Below are the results of the survey:

April 2, 2020: COVID-19 Loan Program Updates

Lenders are preparing documents and moving as fast as they can to start processing the PPP loans. Borrowers are trying to figure out what the best loan package would be for their respective businesses. I think I can safely say that It’s a Mad, Mad, Mad, Mad Covid-19 Rescue Loan World (if you haven’t seen the movie, add it to your list of things to watch….it can’t be that long by now).

Here are some things that we think may be important to know.

- SBA Lenders Approach to PPP Processing Varies: We have been hearing from many lenders that they will only work with their existing customers first. It is understandable. One lender noted that last year they processed 1500 SBA applications in total. With the PPP, they are expecting 40,000 applications. Talk about overload. In case you did not have a lender identified, please see the linked list for contact information. We are also linking a helpful worksheet which may help you determine your payroll for the PPP amount. Lastly, if your current lender or bank is SBA approved, then I would suggest approaching them first.

- One of many unintended consequences: An article was forwarded to me that discussed the unintended consequences of the various loan programs for the restaurant business. If you have a few minutes, I would suggest reading it. The link to the article is here.

- Requests for PA Waivers for non-life-sustaining business will close tomorrow at 5pm. The link to submit a waiver is available here.

- Upcoming Webinars:

April 2, 2020: Interim Final Rule for PPP issued

In trying to keep you as up to date as possible, linked is the Interim Final Rule for the Payroll Protection Program (PPP). For those that don’t know what an interim final rule means, it is essentially the final rule with a timeframe to make additional comments and clarifications. It is used when something is passed and implemented quickly.

Below are the high-level bullet points that I thought were new or provided more clarification. The big one is the interest rate is 1%, not 0.5%.

- Lenders are not required to comply with the SBA’s lending criteria. They can rely on certifications of the borrower to determine eligibility and use of the proceeds.

- Lenders will be held harmless for borrowers’ failure to comply with program criteria

- If you do not have traditional payroll documentation, you can provide other forms such as bank records that can show your payroll.

- You are ineligible if you are a household employer (i.e., you have a nanny or housekeeper)

- The applicable interest rate is 1% and the term is two years. This is different from the prior guidance of 0.5% and 2 years.

- E-consents/E-signatures are permitted.

- PPP is first come, first served.

- PPP loan payments are deferred for 6 months, but interest will accrue during the deferral period.

- Independent contractors do not count as employees for PPP loan forgiveness

- Applicants must submit Form 2483 and payroll documentation. Lenders must submit Form 2484 electronically.

- If you received an EIDL loan from 1/31/2020: 4/3/2020 and it was not used for payroll costs, then you are eligible for a PPP loan. If your EIDL loan was used for payroll costs, then the PPP loan must be used to refinance your EIDL loan.

- If you received any advance (up to $10,000) on the EIDL, it will be deducted from your loan forgiveness amount on the PPP loan.

- Agent Fees (i.e. consultants) will be paid by the lender from the fees they receive from the SBA. Fees may not be collected from the borrower or out of the PPP loan proceeds.

I am sure there are still lots of questions. Let us know if we can help answer any of them (to the best of our ability).

April 3, 2020: PPP Application Submissions….its kind of like Black Friday Shopping…but this is actually serious!

I hope all of you who are eligible got your paperwork in for the Paycheck Protection Program. Like any mad rush, the system got overwhelmed and we are hearing that processing has been delayed. It’s kind of like Black Friday Shopping: A lot of craziness for lots of deals….but this is actually serious!. Let’s hope the processing issues get resolved and the funds get to as many businesses as possible.

A few things:

- PPP Application: Please make sure you are using the latest PPP application. Linked is a copy. If you have not submitted the paperwork as of yet, we have a list of SBA lenders linked. We have also created a memo which outlines the Interim Final Rule (i.e. guidelines) for the loan along with some other useful PPP docs. Also, the PPP worksheet that we sent around yesterday was meant purely as a helpful tool. It was shared with us by a local lender. It may not be up to date with the latest guidance from the SBA.

- NJ Economic Relief Program for Businesses: Apologies for not sending this out earlier. Here are the links for the NJ relief for small businesses. The application period is open until April 10th.

- 10 Point Plan for Restaurant Employers: The following article has a good 10 point plan for restaurant employers. It may be of use if you are in the restaurant or hospitality business. The link is here

- Market goes up more than down over time: Check out the linked chart from Jackson National Life Insurance Company. It highlights the various crisis events and the subsequent market returns. Pretty interesting. Thanks for forwarding to me Larry Moskowitz.

- Retirement Accounts present another funding option from the CARES Act (WE ARE NOT OFFERING AN OPINION ON THIS….MERELY PROVIDING THE INFO…TALK TO YOUR PLAN ADMINISTRATOR OR FINANCIAL ADVISOR FOR MORE DETAILS)- The CARES Act allows eligible participants to request penalty free distributions of up to the lesser of $100,000 and qualified loans of up to $100,000 or 100% of a participants vested balance for qualifying corona-virus related reasons. The reasons could be:

-

- You have been diagnosed with COVID-19

- You have been significantly impacted financially (i.e., furloughed, laid off, work hour reduction, business closure, etc.) due to COVID-19.

- Upcoming Webinars:

-

- Attract Capital (Dave Barnitt, dbarnitt@attractcapital.com): See the linked announcement for a Coffee Chat scheduled for next Tuesday April 7th, 10am.

-

-

- Huntington Bank, COVID-19 SMAR Talk Weekly Webinar, Wednesday April 8, 2020, 1pm-2pm: The registration link is here.

-

Please see all of our updates at the following link: https://mpl-law.com/resource-center/

As always, please don’t hesitate to email myself, Andy Miller (amiller@mpl-law.com) or Christian Miller (cmiller@mpl-law.com) or anyone in our office with any questions or comments.

April 5, 2020: Covid-19 Disaster Funding Programs – If you stare long enough, you will see a sailboat

More clarification about the various SBA programs came out late Friday. These rules are getting a little clearer as time goes by. Please use common sense and rely on your professional advisors when considering your options. However, I can’t help but feeling like the guidance around the programs is a lot like the magic eye scene in Mallrats. If you stare long enough at the various Covid-19 disaster funding programs, you will see a sailboat (or at least find something that fits your situation).

Here are some things that we found relevant:

- Affiliated Business Guidance for PPP Loans: Essentially, if a business operates with a number of separate affiliates, they are all rolled up into one entity for PPP eligibility purposes. However, there are waivers for hospitality businesses and faith-based organizations. Please review the linked documents (Affiliation rules overview, DOT Affiliation Interim Rule, SBA Faith Based FAQ) for further clarifications.

- PPP Successes: I have confirmation of two companies locally that received preliminary approval for the PPP loan. While I have heard of more issues that the processing system is overloaded, it should continue to improve and more will be approved. See the linked list for SBA lenders and consultants if you have not applied yet.

- TSA #s show the dramatic drop in travel: Check out the travel numbers on the TSA Site. From March 16th to present, flying has come to an almost stand still. It would be nice to see the recovery of these numbers snap back as quickly as they fell. Time will tell.

- Planning and managing layoffs/furloughs: While I hope these are kept at a minimum, it is an unfortunate reality that layoffs and furloughs are going to occur because of the current situation. The article, written by David Ulevitch (a general partner from Andreesen Horowitz), at the following link provides some useful things to think through before and during implementation. Here is the article link.

- Upcoming Webinars:

- The Council for Insurance Agents and Brokers; PPP Program Overview; April 6th @ 1130 (From Jeff Kile @ the Glatfelter Agency): The registration link is listed here.

- Attract Capital (Dave Barnitt, dbarnitt@attractcapital.com): See the linked announcement for a Coffee Chat scheduled for next Tuesday April 7th, 10am.

- Huntington Bank, COVID-19 SMAR Talk Weekly Webinar, Wednesday April 8, 2020, 1pm-2pm: The registration link is here.

April 6, 2020: More PPP info (or confusion) & Lunchspirations Podcast Registration

More PPP info (or confusion) & Lunchspirations Podcast Registration

We have the start of another week and the data keeps coming.

Coming up on Wednesday 4/8/2020 from 12-1pm, James Sanders will be doing a live online interview for Lunchspirations (hosted by Karl Diffenderfer) to talk about business disaster recovery programs and other issues surrounding businesses in this environment. If you would like to register to attend, the link is available here.

Other than that, here is some information that we think is of value for you:

- PPP – More confirmations have come through of loan pre-approvals. Check out the latest from the Hustle — the two items below are pretty informative:

- Hustle Small Business Resource Guide

- Reddit Guide for Small Businesses (from the list of links in the Hustle Small Business Resource Guide): the stories shared on here provide some good anecdotal evidence of business owners experiences applying for the different disaster recovery programs.

- Wells Fargo puts a cap on their PPP loan participation. Check out the story here. If you have not applied as of yet, I would recommend you reach out to your lender or one of the contacts on the linked list. FYI, the list below is documents one lender is requiring to put the loan application into the system.

-

- Most recent business tax return

- 2019 Total Gross Sales/Revenue (we just need the dollar amount)

- Year Business was Established

- Driver’s License (FRONT AND BACK) for all owners > 20%

- 940 AND 941 reports (12/31 and 3/31/20)

- Payroll report from 2/15/20 (or closest date)

- Annual payroll report for 2019 year end

- Did you apply for the $10K Advance from EIDL (if yes, have you received the $10K?)

- PPP Questions I am hearing most often today:

- Is there a size limitation for a small business other than <500 employees?

- According to the interim final rule, a small business is “ defined in section 3 of the Small Business Act (15 USC 632), and subject to SBA’s affiliation rules under 13 CFR 121.301(f) unless specifically waived in the Act.” So, what does that mean. Well, the SBA has a good link to help you determine if you are a small business. The link is here. If you have any questions, please let me know.

- What happens if I apply for the PPP loan, bring back all of my workforce and then have to subsequently let people go because of the current situation during the first eight weeks?

- Essentially, you would have a low interest loan for any amount that does not qualify for forgiveness that could be paid back at any time.

- Is there a size limitation for a small business other than <500 employees?

- Upcoming Webinars

- NFIB & VP Pence provide a Coronavirus Update (4/7/2020 from 11am-12pm): The live streaming link is available here.

- Attract Capital (Dave Barnitt, dbarnitt@attractcapital.com): See the linked announcement for a Coffee Chat scheduled for next Tuesday April 7th, 10am.

- Huntington Bank, COVID-19 SMAR Talk Weekly Webinar, Wednesday April 8, 2020, 1pm-2pm: The registration link is here.

-

April 7, 2020: When will this be over? PPP FAQ

When will this be over? I wish I had an answer, but what I can tell you is that I am hearing more and more from very influential people is that this has to stop. By “this,” they are referring to the economic shutdown. Right, wrong, or indifferent, when I keep hearing the same thing over and over, I know that we are closer to the end of this than not.

Here are some articles that tell me this is the case or at least show a path out.

- “No one wants to talk about this”: CEOs debate the coronavirus shutdown

- A bill that was just introduced by PA lawmakers would seek to secure “waiver[s] to the Governor’s 20200319 TWW COVID 19 Business Closure Order to all public and private construction activities that can adhere to social distancing practices and other mitigation measures defined by the Centers for Disease Control to protect workers and mitigate the spread of the COVID-19 virus.” A link to the bill is here.

- See the linked economic data and market performance from Rob Teeter at Silvercrest Asset Management Group (thanks to Sean O’Dowd for sending to me).

Other than that, I do remain optimistic because private business is helping us to get through this situation and will be the engine which drives the recovery.

Here are some other things that are important:

- PPP FAQ sheet: Rather than reinvent the wheel, I am including the important points which were provided by Chad Bumbaugh at Stambaugh Ness. If you have not applied, please reach out to your bank or anyone on the list.

- Questions 2 & 3 hit on general eligibility.

o Eligible if under 500 employees, or under “small business concerns” standards by NAICS code which we knew

o Added eligibility if meeting “small business concern test” (max net worth not > $15mm, average net income for last two years not more than $5mm)

o Clarified that businesses don’t have to meet all other definitions in Section 3 of SBA.

- Questions 4 – 6 hit on affiliation rules

o Lenders aren’t required to certify, clarified these rules must be applied.

- QUESTION 7 – Clarification of $100k compensation cap

o The $100k Cap applies to only cash compensation – not non-cash benefits like employer contributions to retirement, healthcare, taxes

- QUESTION 14 – Clarification of time periods for calculating payroll costs & number of employees

o Calendar 2019 or preceding 12 months both acceptable

o Average employment or per pay average for determination of number of employees

- Question 15 – Again emphasizes that payments to independent contractors are not in the borrowing base

- QUESTION 16 – Clarification on impact of fed taxes in relation to payroll costs – fed wages withheld do not reduce the wages for purposes of determining the PPP loan amount.

- Upcoming Webinars

Please see all of our updates at the following link: https://mpl-law.com/resource-center/

As always, please don’t hesitate to email myself, Andy Miller (amiller@mpl-law.com) or Christian Miller (cmiller@mpl-law.com) or anyone in our office with any questions or comments.

April 8, 2020: COVID Business Law Update: If you are going through hell, keep going

I am not sure if you have been following the estimates of Covid-19, but I wanted to look at how they have changed over the last several weeks. Check out the numbers and reference links below.

- 3/13/2020 (200,000-1,700,000 estimated Covid-19 deaths in the US per the CDC): The link to the story is here.

- 3/30/2020 (100,000-200,000 estimated Covid-19 deaths in the US per Dr. Fauci): The link to the story is here.

- 4/8/2020: (60,415 estimated Covid-19 deaths in the US per Healthdata.org): The link to the data is here.

While there are a few different sources, the reported estimates continue to fall (thankfully) versus climb. It tells me that we are getting closer to the end of this situation.

- What are you doing to ready yourself and your business for the other side of this situation?

- Have you reviewed your loan documents, applied for emergency assistance, updated your operating documents, checked on insurance coverages, and so on.

- Follow the flow of a dollar from entry into your business all the way to the exit to look for ways to enhance or improve the process.

- Now is the time to have conversations about your business and what it will look like going forward with your trusted group of advisors.

As Winston Churchill said: “If you are going through hell, keep going”

We will get through this situation and you and your businesses will be the engines of recovery.

A few things I felt may be of importance today:

- Disaster Loan Program or Payroll Tax Credit, which is right for my business? Take a look at this article. I think it gives a good overview of the puts and takes of each. Contact your bank or any of the contacts on the linked list if you pursue the disaster loan process.

- SCORE Covid-19 Resource Center: If you are looking for a business mentor or other information from SCORE related to Covid-19 Resources, check out this link.

- Upcoming Webinars:

- NFIB Coronavirus Part V; Friday April 10, 2020; 12-1pm: Register for the event here.

April 9, 2020: Christian Miller’s COVID-19 Legal Updates for April 9th

It has been some time since I sent out an update, as things have been hectic dealing with the new loan programs and assisting many of you with the PPP Loan Application. However, I wanted to get some new information out regarding some updates and additional information on the COVID-19 programs aimed to assist small businesses.

Linked is a memo that provides clarification from the Dept. of Labor regarding implementation of the two paid leave programs (or expansions in the case of FMLA) for employees effected by COVID-19. These were released on April 1st, so if you have already seen them this might be a duplication of information. To provide you with additional context, I am also linking prior memos (1), (2) regarding paid leave programs to fill in any gaps in your recollection of these programs (they have older dates – disregard if a recap isn’t helpful). An important reminder I have been asked about is the interplay between the paid leave benefits and the increased unemployment compensation benefits. Please know that these can’t both exist, as the paid leave programs were one attempt to keep employees on payrolls and off UC benefits. So if employees were laid off (and applied for UC), you do not have to worry about the paid leave programs (the payments or the credits) unless an employee is subsequently rehired.

I am also linking an updated FAQ sheet related to the PPP Loan Program. One of the interesting updates (via an added question) is that funds must be disbursed within 10 days of loan approval. Many of you have received PPP approvals, but have not seen any documentation or disbursements, so it will be interesting to see this point in practice. We welcome any questions about the PPP Loan Program, but we also advise discussing with your lender (although you have to understand they are highly burdened right now) as they are the ones charged with administration of the PPP Loan Program, and will be in the best position to advise. Some additional advice on PPP questions is not to plan on how to use the funds until you have the approval and the loan documents/information from your lender. Things remain very dynamic, so it would be best practice to reserve any analysis until you have the loan documents and information (from your lender) in hand to know the exact parameters of the loan. Then is the time to review, ask questions, and develop a plan to best maximize the funds and the forgiveness element. Doing so beforehand requires speculation, and may end up being scrapped in the end. Our office is more than happy and equipped to assist with the review and implementation of the program from a practical ase

Finally, I encourage all of you to take a peek at the information, resources, and contacts on our MPL Law Firm Resource Page. Although it has been a few days since I pushed out an update, this site is frequently updated with new information. For tax information related to the COVID-19 assistance, and more importantly the CARES Act, feel free to review information here from Eisenhart & Co., one of our trusted CPA partners. Thank you, and stay safe.

April 9, 2020: Schools out, at least for this year – Keep Moving Forward

It looks like PA has followed a lot of other States. We were just informed this morning that the PA Dept. of Education has decided to close schools for the remainder of the school year. Thankfully, our school district launched their “Forward Learning” initiative so our kids could continue with instruction online. As a friend/colleague said to me earlier today, “the enjoyment of having lots of family time is wearing off and the kids are missing their friends.” I know some of you can relate.

That being said, the current normal is a place where our personal and business lives continue to collide. I cannot emphasize it enough, it is more important than ever to be working on your business and looking for ways to survive through the current times and thrive when we get through it.

Below are a few articles that may help you navigate the current situation:

- Inc.com:

- Harvard Business Review:

KEEP MOVING FORWARD, IT WILL GET BETTER

A few other things that you should also look at as well:

- Dept. of Labor Guidance for Small Business Exemptions. Please take a look at our linked memo which highlights the new guidance which was issued by the Department of Labor related to exemptions and details of the Family and Medical Leave Ac and the Emergency Paid Sick Leave Act.

- PPP Program Updates: A few things on this

- Additional FAQs were issued last night (see linked document) The two big additions were: 1. SBA lenders could use their own promissory note documents to close PPP loans; and 2. SBA lenders must distribute the funds approved by the SBA within 10 days of commitment. This could cause some business owners to think a little more creatively about when or if they are applying and signing for the PPP loan.

- Tomorrow, the PPP applications for independent contractors and self-employed individuals can be processed. Please reach out to your bank or any other SBA approved lending institution if you need help. Linked is a list of SBA approved lenders and consultants that we have worked with in the past.

- Monkey See, Monkey Do: A bill was introduced in the PA House to force COVID-19 business interruption coverage. This follows similar bills in LA, NY, OH, MA and NJ. The article is here.

- Helpful Resources & Upcoming Webinars

- Karl Diffenderfer, CEO and Founder of Higher Impact Business and Life Coaching, is offering (gratis) his time and advice to business owners during this situation. Please contact him directly (karl@higherimpact.me; 717-201-8536)

- Hitesh Patel, Transworld Business Advisors, sent over the following helpful podcast for entrepreneurs: The Deal Board. He is offering Broker Opinions of Value for owners thinking of selling or planning ahead for an eventual exit strategy. Please reach out to him directly (hpatel@transworldpa.com)

- Town Hall Meetings for CEOs and Owners (4/14 @ 7am): Mark Sussman (mark@strategicbizgroup.com) of the Strategic Business Group will be hosting a virtual townhall for CEOs and Owners. Click here to register to attend.

- RKL Weekly Coronavirus Webinar (4/10 @ 11am)

- NFIB Coronavirus Part V; Friday April 10, 2020; 12-1pm: Register for the event here.

April 10, 2020: Top Ten EIDL and PPP Questions

NFIB Top Ten List

#10 – EIDL or PPP, which do you recommend, or should I do both?

The short answer is you can apply for both, but you cannot use the money for the same purposes; I also learned that EIDLs would be capped at $15k per application if you have not received approval yet. It looks like $2,000,000 is not an option right now for the EIDL. PPP is the only program where applicants are receiving approvals and funds from what we have heard recently. Also, if you are in the Ag business, you are eligible for the PPP loan program, but are not eligible for the EIDL

#9 – Speaking of EIDL, what’s up with the $10,000 grant? I thought it was coming in 3 days.

There is no word on when these grants will be funded. However, we learned that these grants will be limited to $1,000 per employee up to the $10,000 maximum.

#8 – I’m going to apply for a PPP loan. How do I calculate payroll costs for employees who make more than $100,000?

You are capped at $100,000. Anything above that is not counted.

#7 – Could they make this any more confusing? My head is spinning. Once again, can you explain the formula for PPPL forgiveness?

You have 8 weeks to spend the money from the loan funding date for payroll and approved expenses (e.g., rent, mortgage, utilities). If you don’t use the full money during that time for the approved forgivable expenses, the balance converts into a low interest loan. However, if you bring your employment back up to pre-crisis levels from the expiration of the 8 weeks until June 30, 2020, you can hold off on applying for forgiveness until you hit that level or the time expiration, whichever is earlier.

#6 – What kind of documentation will I need for PPP loan forgiveness?

You need documents that verify the # of full time equivalents (FTEs), their pay rates, mortgage payments, utility payments and/or rent payments. The lender then has 60 days to approve or deny the forgiveness. Also, keep in mind that if you reduced salaries by more than 25% after 2/15, you need to bring them back up to the pre-crisis level to get the full forgiveness amount. You will also need to bring FTEs back up to pre-crisis levels to get full forgiveness. Anything below these amounts will proportionately reduce your amount of loan forgiveness.

#5 – I got the PPP Loan. But, what if I need to terminate employees or someone quits, or I can’t keep the business open after June 30th or my 8-week forgiveness window? Is this going to impact my loan forgiveness eligibility?

If you terminate or someone quits in the 8 week window, you have until 6/30/2020 to get your FTE back up to the pre-crisis levels. It does not need to be the same person rehired as well. After the 8 week window, there is no owner responsibility to keep the FTE at the pre-crisis levels or keep the business open in order to qualify for the forgiveness.

#4 – What if I can’t reopen my business until mid-May (or June here in Virginia)?

You can wait to apply for the loan until it makes sense. You have to apply before June 30, 2020. Please remember that the program is first come first serve. If you are approved, receive the funds and cannot open, you have a 1%, 2 year loan. You do have until 6/30/2020 to get back to pre-crisis employment level in order to qualify for loan forgiveness.

#3 – Banks are confused about the program and mine is not participating. Where can I apply for the PPP Loan?

Go to your bank as the initial starting point. (From Me: Check out the linked list if your bank does not participate).

#2 – I had to layoff most of my employees last month and they have now filed for unemployment. Should I still consider a PPP loan? What if they don’t want to come back to work (unemployment pays well these days)?

The PPP loan is still a viable option if you plan to rehire to pre-crisis levels. You do not have to rehire the same people back.

#1 – I applied for an EIDL, and for the emergency grant, and for a PPP loan. When the heck will I see money in my bank account?!? HELP!

For the EIDL and the emergency grant, the processing is extremely backlogged, which has resulted in the reduction in the amount that is available per applicant (see #9 above). There has been no guidance from the SBA on this program. For the PPP loan program, there was a bottleneck because the bank’s did not know what documents to use to close the loans. With the recent guidance from the SBA & Dept. of Treasury that banks can use their own documents to close loans, the funds should start flowing. Remember, that SBA lenders have 10 days to fund the loan from the date of approval.

Bonus Questions:

Are phone and internet considered utilities for PPP loan forgiveness? Yes

Is the Fed buying up PPP loans? Yes, they are buying the loans from the banks in the secondary market which will keep banks from hitting their lending limits. So, the issue that Wells Fargo announced earlier in the week is not an issue any longer.

I don’t have employees, but have utilities, rent and/or mortgage. Given the issues with EIDL, can I apply for a PPP loan? For the PPP, you need to use 75% or more of the loan proceeds for payroll and the remainder for the other approved expenses. There has not been any guidance given as to the penalties if you do not meet this breakdown. This applies to the usage of the proceeds over the life of the loan, not just the amount you are applying for forgiveness.

Here are some other items that I think may be of importance for you and your business:

- PPP Program Rollout, Not so Smooth: That is definitely an understatement. Check out the linked article from the Central Penn Business Journal for some interesting stats and anecdotes.

Various Program Updates (I received these from Chad Bumbaugh at Stambaugh Ness. I could not have written it any better….thanks!)

-

- Main Street Lending Program Announced by Federal Reserve

- Aims to provide funds to small and medium sized businesses

- Would provide loans for businesses with up to 10,000 employees / $2.5 billion in 2019 revenues (4 years loans with no forgiveness provisions)

- Loan “fact sheet” provides key terms – note that businesses can participate in both this program and the PPP. Certainly will be more details to follow.

- IRS Extensions

- The IRS announced additional due date extensions yesterday. This effectively extended the due date for almost all federal tax filings to July 15th (and most states have followed suit)

- The extensions of the due date for second quarter estimated tax payments from June 15th to July 15th will likely impact the most individuals. Fortunately this clarification ends the bizarre scenario of having the first quarter estimate being due (7/15) after the second quarter estimate (6/15).

- Main Street Lending Program Announced by Federal Reserve

- NJ Small Business Loan Program Application Program Starts April 13th: Small businesses with annual revenue of up to $5M are eligible for up to $100k loans at 0% interest for 5 years. (Thank you to Larry Moskowitz of Certified Financial Services for bringing this to our attention)

Other Useful Resources

-

- Zoom Meeting Etiquette: Check out the linked helpful hints from Lisa Torba of J. Hilburn Partners.

Happy Easter, Happy Passover and Happy (any other holiday I am missing this week) to you and your family!

April 13, 2020: MPL General Counsel Corner – Another day closer

I trust the holiday weekend went as best as can be expected. I don’t have any major theme other than to highlight some little know provisions of the various relief programs that may be important and relevant to your business. I know I said it multiple time last week, but I am hearing and reading more and more about opening up the economy and loosening restrictions. The Governor in Texas is rolling out a plan to open the State’s economy, while the Governor in Florida is talking about schools opening up in May. The IHME projections for the US have also remained steady over the last few days. We are another day closer to getting through this situation.

What are you doing to prepare your business or organization for a reopening of the economy? I can tell you with almost 100% certainty, it will not happen in the way or speed that you think.

Here are some other things that may be relevant to your business or organization:

- What about the Net Operating Loss and other Business tax provisions of the CARES Act? A not as widely discussed, but important provision of the CARES Act was the update to the ability to utilize net operating losses from the previous rules under the 2017 Tax Cuts and Jobs Act. I think it is important to realize the increased benefits of this provision as you prepare your 2019 returns and plan for 2020. It could be another source of capital. Check out the article by RKL related to NOLs and other business tax provisions under the CARES Act.

- DOL’s OSHA issues guidance for Covid-19 Recordkeeping: On Friday, the US Dept of Labor temporarily suspended enforcement of the record keeping requirements for Covid-19 illness except for business/entity is in the healthcare, emergency response or correctional business.

- Business/Organization Planning Resources: The two linked studies from McKinsey are good things to review related to Crisis Preparedness and Marketing for your business/organization during this time. I recommend reading them if you have time. Exhibit 2 in the Crisis Preparedness link was particularly helpful for scenario analysis and reaction. The marketing study is a good thing to review in any downturn.

- Upcoming Webinars and Resources

- Pitchbook – Sourcing deals outside traditional channels – 4/15 (12am-1pm) – Here is the registration link.

- Giant Company Grant: Giant Food Company has set aside $250,000 for small businesses connected to food. The application is available here. The max single grant is $15K.

As a side note, our list of email recipients is growing to the point where we will be using a mail delivery service such as MailChimp or Constant Contact. We will let you know when we are close to the launch.

April 15, 2020: MPL General Counsel Corner – Let’s Hope These Aren’t Meetings About Meeting

I was happy to hear that more State Governors are talking more about opening up the economies in their region. Aligning much the same way as fans of 90s hip hop, two groups of Governors (East Coast: NY, NJ, CT, MA, PA and RI; and West Coast: CA, OR and WA) have announced plans to coordinate efforts to re-open businesses and ease social distance guidelines. Let’s hope these are serious meetings with actionable items on the agenda and not just meetings about meeting more. It is scary to see how quickly the economies were shuttered. The speed of the economic reopening and recovery is going to be contingent in a big way on your efforts.

A few topics that I think may be of interest today:

- IRS Payroll Tax Deferral FAQ Issued (This is from an update provided by Chad Bumbaugh at Stambaugh Ness)

-

- The IRS recently issued a payroll tax deferral FAQ which gets into the details of the payroll tax deferrals and the interaction with other stimulus provisions. Of particular note is question #4 which states that businesses receiving a PPP loan may defer deposit and payment of the employer’s share of social security tax from March 27, 2020 through the date the lenders issues a decision to forgive the loan without incurring failure to deposit and failure to pay penalties.

- Fiduciary Considerations and the CARES Act (This is from an update provided by Chad Bumbaugh at Stambaugh Ness)

-

- The CARES act contains a number of changes impacting retirement plans. For a brief overview of some of the key provisions and some commentary check out this article from Fiduciary News.

- NFIB Survey Shows A Surge in PPP and EIDL Applications: That was 5 days ago and the numbers are likely higher. It is not to late to get into the action. Contact your bank or lender first and if they don’t participate, we have linked a list.

- Private Equity is sitting on lots of dry powder ($1.7 Trillion by some estimates): Check out the article provided by Steve Raymond at The DAK Group on Preserving Business Value in Times of Economic Reckoning.

- Upcoming Webinars and Resources

-

- Pitchbook – Sourcing deals outside traditional channels – 4/15 (12am-1pm) – Here is the registration link.

- Giant Company Grant: Giant Food Company has set aside $250,000 for small businesses connected to food. The application is available here. The max single grant is $15K.

As a side note, our list of email recipients is growing to the point where we will be using a mail delivery service such as MailChimp or Constant Contact. We will let you know when we are close to the launch.

April 16, 2020: Attorney Christian Miller: COVID-19 Update

I hope everyone has been weathering the storm well. It often seems that things related to small businesses and COVID-19 stimulus change at light speed. In addition to my periodic updates, our MPL Law Firm Resource Page is frequently updated (usually daily). I encourage all of you to check back at this information and its resources for any updates that might be especially applicable or helpful to your situation.

Governor Wolf issued an order yesterday for businesses to implement specific safety precautions. The full order is linked. Currently, this only applies to life-sustaining/essential businesses (or those operating under a waiver) that are permitted to continue in-person operations. The order involves a detailed list including cleaning specifications, distancing, work breaks, mask usage, and protocols in the event an individual at your business (employee, customer, or guest) is suspected of having COVID-19 (including reporting, closing down for 24 hours, cleaning, and reopening). Although these naturally only apply to businesses permitted to continue operations right now, it is worthwhile for all businesses to look into the requirements. I have a feeling that, as the economy reopens in PA (and beyond), employers will be charged with implementing these same procedures to operate as a condition to reopening in general.

The PPP Loan program seems to be an ever-evolving animal in itself. We have seen a variety of loan documents from different lenders, and thus far no two seem to be the same. The good news is that businesses are getting approved and funded. But the changes to the program are still coming, as recently as April 14th, when the SBA issued updated guidelines. Of particular note is that partners in a partnership (which includes members of an LLC taxed as a partnership) should treat their compensation (guaranteed payments or distributions) as part of the “payroll costs” (subject to the $100,000 limit) on the partnership’s PPP loan application. This is a reversal from guidance which said each partner should individually file a PPP application. Affected applicants are encouraged to immediately reach out to their lender if they did not calculate partner/owner compensation in “pay roll costs” as provided in the linked document. For reference, linked are the updated guidance, with the partnership issue discussed on pages 4 and 5.

Working capital, beyond stimulus funds, is a great concern for many businesses once they get to the other side of this shut-down and pandemic. David Barnitt, with Attract Capital, a middle market broker which our office works closely with, recently provided a short talk on replenishing funds and restarting business using different resources and lending facilities. It is a relatively short clip (about 16 minutes) and worth a watch to pick up some valuable insight. You can watch it here:

https://www.facebook.com/AttractCapitalLLC/videos/2635945043346072/

Again, I encourage all of you to periodically review our MPL Law Firm Resource Page. And for tax information related to COVID-19 issues, feel free to review information here from Eisenhart & Co.. Thank you, and stay safe.

April 16, 2020: MPL General Counsel Corner – Going, Going….Gone (Maybe?)

We are hearing that PPP will run out of money (likely today), unless Congress acts soon. Hopefully they will do the right thing to support the largest employer in the country, SMALL BUSINESS. If you have not started the process yet, I would highly recommend you reach out to your bank/lender or start contacting the contacts on the attached list. If you don’t, as they say in baseball, PPP will be going, going….gone.

A few things that may be of importance for you to know today:

- The Business Interruption Insurance Coverage drum beats louder: Check out the story on this topic from the Insurance Journal.

- Who Has Approved Loans and What Banks are Expecting: Check out the daily update from Joel Berg and BizNewsPA. It give a great run down of the stats of the PPP loans and also provides some insight as to what some banks are expecting for bad loans related to this situation.

- How to replenish your funds and restart your business: Dave Barnitt from Attract Capital hosted a Facebook webinar recently and provided some useful tips for generating working capital for your business. You can access the presentation here.

- Glimmer of Hope That The Economy Will Reopen: Yesterday, the State of PA issued guidelines for essential businesses. Perhaps this will be the roadmap for a reopening of “non-essential” businesses.

April 17, 2020: No more PPP, No More EIDL, Now What?

Lots of info to digest today. Good thing it is Wednesday, no wait, Thursday. No, that’s not right. Well, it’s a day that ends in “y”. With PPP and EIDL halted, now what?

Check out the info below for some insights that may be relevant to you:

- Opening Up America Again: In case you missed the press conference last night, check out the guidelines published by Presidential Taskforce about the phased economy reopening.

- Where do I go if I did not apply for a disaster relief program? With PPP halted (hopefully temporarily) and the SBA not accepting any more EIDL applications, the options are limited. However, check out the available programs which were sent out by SCORE:

- U.S. Chamber of Commerce: Save Small Business Fund. The Save Small Business Fund is a grantmaking initiative led by the U.S. Chamber of Commerce Foundation. The fund will offer $5,000 grants for employers across the country. They also developed a Coronavirus Small Business Guide.

- Nav: Small Business Grant Contest. Nav is giving grants to small businesses that tell a story of preservation and opportunity in the face of a past or ongoing challenge. Apply by May 30th

- Facebook: $100M in Grants for Small Businesses. Facebook is offering $100 million in grants to support over 30,000 small businesses in over 30 countries. Check if your small business is eligible.

- Will There Be More Funds Available for the PPP or other programs? A plan B, if Congress does not act, is being talked about. Check out the article from Inc.com here.

- I got the PPP funds, now what? More guidance will no doubt be issued on PPP forgiveness. In the interim, check out some resources that may be helpful:

- Check out a recent Forbes article about the Ten Things We Need To Know about PPP Forgiveness.

- Please make sure you are signed up for RKL’s weekly webinars (every Friday at 11am). They mentioned on today’s call about rolling out some helpful PPP Loan Forgiveness and Cash Forecasting tools and information in the coming week. Stay tuned.

- And now from the lighter side: Professional Gamblers in Nevada may be able to collect unemployment……With no golf allowed in PA, a lot of my golf buddies could do the same thing given how much I have lost to them over the last few years.

April 19, 2020: You Don’t Have to Participate in A Downturn

With the PPP funds exhausted, we thought it would be helpful to share some of the high level loan data from the SBA. Approximately 87% of the approved loans were less than $350,000, with the average approval being ~$200,000 per applicant. Approximately half of the total approved loans went to the following industries:

1. Construction – ~13%

2. Professional, Scientific and Technical Services – ~13%

3. Manufacturing – ~12%

4. Healthcare and Social Assistance – ~12%

While specific business categories were not provided, you could assume that the companies in these industries were either considered essential or are likely to be the first to come back online once the economies open up. I think that is vitally important that you continue working the ramp up or reopen plan for your business or organization once we get the green light.

This article may help: The Reopening Challenge: 5 Tips For Getting Back To Business

Here are some other important updates and resources:

- Trout CPA Covid-19 Resource Page: The two latest additions may be of most interest for PPP recipients (thanks to Brian Wassell for sharing with us)

- PPP Loan Forgiveness Calculator Template

- FAQ – PPP Loan Forgiveness

- PA Unemployment portal is open for self employed individuals, independent contracts, and so on. Time will tell if S-Corp owners will eventually be included.

- What are the tax consequences of stay at home orders for people that live in one state and work in another? Check out the article sent by Chad Bumbaugh from Stambaugh Ness.

- Upcoming Webinars

- RKL Weekly Coronavirus Webinar Series (Fridays)

- Stambaugh Ness Town Hall (Tuesdays 2-4pm)

- National Small Business Town Hall presented by Inc.com and the US Chamber of Commerce (4/24 @ 12pm) Here is the registration link.

I will wrap up tonight’s update with the following message that has helped me get through prior tough economic times (author unknown, but wise):

You don’t have to participate in a downturn.

April 20, 2020: Race to open….kind of

A few states have provided guidance on how they will be reopening their economies. In Pennsylvania, Governor Wolf set May 8th as a target date for regional reopening, but did not provide many details as to what that meant. In New York, New Jersey, and Connecticut, the Governors are talking about lifting the lockdown provisions in June. Georgia and Tennessee have both decided to lift the stay-at-home orders on April 30th. Like anything else, I think once the economies get rolling, it will hopefully be tough to stop.

In other news, it looks like a $470B Phase 3.5 stimulus package is close to being finalized. Stay tuned…this will only get more interesting.

A few things that I think may be relevant or important for you to know:

- NCCI Waives Workers Comp Premium Payment – The National Council on Compensation Insurance (NCCI) announced today that it waived the payment of WC premiums for businesses that are still paying employees who are not working. This decision will be filed with the regulators of the 36 States that follow NCCI guidelines. Thanks to Rudy Kocman of Kocman Insurance Group (Rudy@kigyork.com) for sharing.

- Bankruptcy – Not the preferred option, but something to understand: Under the CARES Act, the debt limit to qualify to be a debtor has been increased to $7,500,000 for the next year, up from $2,725,625. Moreover, small businesses can go through reorganization in Chapter 11 within months (instead of years), with it costing much less. Please check out the attached overviews for debtors and creditors from Rob Bovarnick (RBovarnick@rbovarnick.com), a seasoned business and bankruptcy attorney.

- Upcoming Webinars and Helpful Resources

- RKL Weekly Coronavirus Webinar Series (Fridays): Here is the link for the upcoming and prior webinars. Also, check out the overview of their PPP Loan Forgiveness Cash Flow Forecast.

- Stambaugh Ness Town Hall (Tuesdays 2-4pm)

- National Small Business Town Hall presented by Inc.com and the US Chamber of Commerce (4/24 @ 12pm) Here is the registration link.

- What Plan Sponsors Need To Know About The CARES Act. This article, provided by Brian Shannon from ClearSage Advisory Group (Brian.Shannon@

ClearSageAdvisoryGroup.com), gives a good overview of your options for accessing retirement funds as another source of capital.

April 21, 2020: MPL General Counsel Corner – Why are we waiting?

As reported yesterday, COVID Relief Package 3.5 is being debated. It appears to be somewhere in the neighborhood of a $470B package, with $370B earmarked for small business funding ($310B for the PPP loans).

The real question: Why are we waiting?

A few things that I think may be relevant or important for you to know:

- If I don’t get or take a PPP or EIDL loan, what are some other options? Trout CPA published a good overview of the various business tax programs which have been launched under the CARES Act. NOLs and Employee Retention Tax Credits could be other relief options.

- PA’s Economic Reopening and some other interesting data: Check out the latest update from Joel Berg at BizNewsPA. He overviews the reopening plan announced by Governor Wolf yesterday and also highlights some of the largest local PPP lenders.

- Beware of IRS Scams: I am sure you know the general ways that the IRS will contact you, but in case you don’t here are some helpful reminders:

- The IRS will generally first contact people by mail, not by phone, about tax-related matters.

- If the IRS does contact you by telephone, they will not insist on any pre-payment using an iTunes card, gift card, prepaid debit card, money order, or wire transfer, in order to receive economic impact payments.

- The IRS will also never request personal or financial information by e-mail, text, letter, or any social media.

- Upcoming Webinars and Helpful Resources

- RKL Weekly Coronavirus Webinar Series (Fridays): Here is the link for the upcoming and prior webinars. Also, check out the overview of their PPP Loan Forgiveness Cash Flow Forecast.

- Stambaugh Ness Town Hall (Tuesdays 2-4pm)

- National Small Business Town Hall presented by Inc.com and the US Chamber of Commerce (4/24 @ 12pm) Here is the registration link.

The Senate passed the Paycheck Protection Program Increase Act of 2020 late this afternoon. Now it moves to the House, which hopefully will not be the stumbling block like last time.

Here are the major highlights:

- PPP program increased from $349B to $659B

- EIDL program increased from $10B to $20B

- Allows agricultural enterprises with not more than 500 employees to receive EIDL grants and loans

- Sets aside additional PPP funding for Insured Depository Institutions, Credit Unions and Community Financial Institutions.

- Provides an additional $2.1B for Salaries and Expenses account to remain available until September 30, 2021 (I assume this is the extension of the infamous June 30th, 2020 deadline under the CARES Act, but it is not clear in the high level bullet points)

- Provides $50B for Disaster Loan Program Account to remain available until expended.

- Provides an additional $10B for Emergency EIDL Grants to remain available until expended.

April 22, 2020: Crickets from DC, but Fireworks Likely in Harrisburg

Doing a scan of the various major news outlets, I don’t see much in the way of controversy over the PPP Increase Act of 2020 (aka, Stimulus 3.5). All you can hear are the crickets out of DC, which tells me that Stimulus 3.5 is likely to be passed and approved by President Trump tomorrow. If you have not submitted your PPP application, I would strongly suggest you contact your bank or lender ASAP.

In local news, there is a big disconnect between the Republican controlled PA State Legislature and the Democrat Governor. It may be worth your time to watch tomorrow’s Senate hearing. It starts at 10am and the link for access is here. When you look at tomorrow’s panel combined with recent remarks from Governor Wolf about employers and employees going on unemployment and mix in some commentary from the floor of the PA House, there are likely to be fireworks in Harrisburg tomorrow.

A few things that I think may be relevant or important for you to know:

- NFIB Update on Stimulus 3.5, PPP Forgiveness and Alternative Funding options: The NFIB conducted a small business update today. Below are the key points from the presentation:

- Stimulus 3.5: It goes to the House for a vote tomorrow, which is likely to pass and be signed by President Trump shortly thereafter.

- PPP Forgiveness Overview and Clarification. There are some helpful slides and examples as to what counts for PPP forgiveness, what does not and what needs to be further clarified.

- Alternative Funding Options were also reviewed. Of note, check out the link to all the State Governors’ sites, which will have any available State specific relief funding options.

- WC Insurance Recommendation from PCCI – Update: I sent out a release earlier this week from the NCCI related to Workmen’s Comp payments and mistakenly referred to the recommendation as a waiver of payments, which it is not. Apologies for any confusion and here are the corrections/clarifications:

- Correction: The recommendation from the NCCI is that payroll dollars that are being paid to workers that are not actually working may be excluded from the annual audit done to determine your upcoming WC premium (i.e., it should lower your upcoming premium, not waive it as I wrote).

- Clarification: PA is not an NCCI State. It is governed by the PA Compensation Ratings Bureau.

- Insightful Commentary on the Market: Brian Luster, Chief Investment Officer of Collective Family Office, sent out a market update (Why isn’t the market more worried about the social distancing recession?) that has 7 key points which I think are very insightful (see below):

- Remembering an Important Lesson from Recent History

- Global Covid-19 Incidence Rates are Stabilizing

- The Economy Isn’t A Democracy

- Earnings Drive Valuations

- Investors Are Again Being Pushed Up the Risk Spectrum

- The Expectations for a Reopening of the Economy are Accelerating

- Markets Bottom Well in Advance of the End of a Recession

- Upcoming Webinars and Helpful Resources

- RKL Weekly Coronavirus Webinar Series (Friday, 4/24 @ 11am)

- Stambaugh Ness Town Hall (Tuesdays 2-4pm)

- National Small Business Town Hall presented by Inc.com and the US Chamber of Commerce (4/24 @ 12pm)

April 23rd, 2020: No Word Yet from DC

No word yet from DC on the passage of Stimulus 3.5. All signs are indicating its approval. I guess it just takes time to debate & let their constituents know their thoughts…or they just like to talk.

Stay tuned….

A few things that I think may be relevant or important for you to know:

- Big Business Clarification: The Department of Treasury added to the PPP FAQ today. I assume this is in reaction to publicly traded companies receiving PPP funds. Essentially, if you have the ability to access the capital markets, you would not be able to make a good faith certification that you need the PPP loan.

- PPP Loan Forgiveness and State Income Tax: Check out the article in Bloomberg about how States may handle PPP loan forgiveness. If you are located in one of the high tax States, then you should be paying attention to what your legislators are considering. (thanks to Chad Bumbaugh from Stambaugh Ness for sharing)

- PA Governor Wolf Provides More Details on Reopening: Check out the latest updates from Governor Wolf on the phased reopening of PA. Maybe some of the heavily suggested recommendations from the business community are being heard.

- Upcoming Webinars and Helpful Resources

- RKL Weekly Coronavirus Webinar Series (Friday, 4/24 @ 11am)

- Stambaugh Ness Town Hall (Tuesdays 2-4pm)

- National Small Business Town Hall presented by Inc.com and the US Chamber of Commerce (4/24 @ 12pm) Here is the registration link.

April 24th, 2020: General Counsel Corner – PPP: Think Before You Apply

The House passed Stimulus 3.5 last night. Hopefully, the applicants will in good faith need and ultimately receive the funds. As pointed out yesterday in the latest PPP FAQ, you are attesting in “good faith” that you need the funds and do not have access to the capital markets for your liquidity needs (i.e., you have no other option to get money to stay in business). One other thing to mention is if your bank or lender is not accepting applications, please go to another SBA lender. You are not required to use your own bank, but it is recommended. Here is our list that was compiled before PPP round 1.

Please think before you apply for PPP or other relief program funds.

A few things that I think may be relevant or important for you to know:

- Who were the big lenders in PPP Round 1? Check out the links and articles below for a quick run down

- Nationally: Check out www.covidloantracker.com. It is put together by a husband and wife entrepreneur duo and has some very interesting data (thanks to Joel Berg @ BizNewsPA who brought this site to our attention).

- Philadelphia Area: The Philadelphia Business Journal did a nice rundown of Philly area banks that provided the most PPP loans. (thanks for Steve Raymond from the DAK Group for the article)

- Pennsylvania: The Central Penn Business Journal provided a good article about PPP lending for the State.

- What will the forgiveness application look like? A WSJ editorial written by Senator Johnson from Wisconsin could provide some insight as to what the application for the forgivable portion of the PPP loan might look like. With the negative PR from organizations like Shake Shack and Harvard initially receiving funds, you can bet that the Federal Government will be adding in more protective measures. I would not want to be on the other side of that group. (Thanks to Attorney Rob Clofine for bringing the WSJ article to our attention)

- Upcoming Webinars and Helpful Resources

- RKL Weekly Coronavirus Webinar Series (Friday, 4/24 @ 11am)

- Stambaugh Ness Town Hall (Tuesdays 2-4pm)

- National Small Business Town Hall presented by Inc.com and the US Chamber of Commerce (4/24 @ 12pm)

April 26th, 2020: MPL General Counsel Corner – An attorney that represents himself has a fool for a client

No movement on restarting PPP and EIDL applications as of today. However, there were some updates from the Dept. of Treasury on Friday. Of note, there were additions to the PPP FAQs (questions 32-35) related to agricultural industry applicants, housing stipends and residency requirements of employees.

I do want to circle back on my message from Friday. Please make sure you think through the ramifications of any relief program you utilize. For example, in the latest Interim Final Rule published by the Department of Treasury on 4/24, there is a clarification which I think you should carefully consider as you look at the PPP loan:

However, in addition to applying any applicable affiliation rules, all borrowers should carefully review the required certification on the Paycheck Protection Program Borrower Application Form (SBA Form 2483) stating that “[c]urrent economic uncertainty makes this loan request necessary to support the ongoing operations of the Applicant.”

Your trusted mentors and professional advisors are here to help you through this process. As a wise person once told me, “An attorney that represents himself has a fool for a client.”

A few things that I think may be relevant or important for you to know:

- US Chamber of Commerce/Inc.com Nation Townhall: Last Friday, the presenters and panelists at the Townhall provided an excellent overview on the current state of the relief programs. Here are a few things that I found of interest:

- You can apply for PPP at more than one institution, but you are only allowed one loan (outside of the affiliated entity exceptions).

- There is no clarity on whether you can also access the employee retention tax credits after you have received PPP forgiveness approval.

- Watch out for fraudulent activities; You should be using lenders that you know and trust.

- Areas in need of clarification: What is included in transportation costs?; and How do you handle retirement contributions (i.e. what time frame do you use)?

- Normal and hazard related payroll bonuses are likely to be allowed for PPP forgiveness, but don’t overdo it. Remember the intent of the PPP loan is to retain employees at pre-crisis levels and pay.

- With remote work a “new normal”, now may be the time to revise or create a company policy around it. This topic was brought up in another roundtable we participated in late last week. SHRM published a good article highlighting the key areas to consider.

- Upcoming Webinars and Helpful Resources

- RKL Weekly Coronavirus Webinar Series (Fridays @ 11am)

- Stambaugh Ness Town Hall (Tuesdays 2-4pm)

April 27th, 2020: MPL General Counsel Corner – …and they are off and running

The Kentucky Derby was originally scheduled for this Saturday, but we will have to wait until September. In the interim the best race we can watch is part 2 of the PPP. As of 10:30am today, SBA lenders are off and running trying to get as many PPP applicants put into the SBA portal as they can. Reviewing the Dept. of Treasury website, there are a few additions that I think are important to understand and review if you are still pulling together documents.

- How to calculate loan amounts: This details the appropriate documents to calculate your loan amount request for self-employed, 1099 Schedule F (i.e. Self Employed Farmers), Partnerships, S-Corps, LLC owners and non-profits.

- What about seasonal employers?: Seasonal employers can now choose a 12-week period using either the previously approved measurement period or a from 5/1/2019-9/15/2019. Also, a seasonal business that was dormant as of 2/15/2020 is eligible to apply if it had to have been in operation for at least 8 weeks from 5/1/2019-9/15/2019.

Here are some other things that may be important or relevant for you:

- State by State reopening plans are a mixed bag:

- Governor Wolf provided additional details for the reopening of PA. Essentially, if fewer than 50 new cases per 100,000 people in a county are reported over the prior 14 days, than they will consider reopening that county. Let’s hope the testing is accurate and the term “consider reopening” becomes “reopen”.

- NJ Stay at Home Order is extended indefinitely.

- Other States are reopening.

- Upcoming Webinars and Helpful Resources

- Stambaugh Ness Town Hall (Tuesdays 2-4pm)

- US Chamber of Commerce Webinars

- Workshop Wednesday (4/29 @ 10:30am): Protecting Your Small Business From Cyberthreats.

- National Small Business Townhall (Friday 5/1 @ 12pm)

- NFIB Coronavirus Small Business Update (4/29 @ 12pm)

- RKL Weekly Webinar Series (Every Friday). To be added to the subscription list, please click here.

April 28th, 2020: MPL General Counsel Corner – Another day, a few more updates

Today’s update is short and sweet, which means that karma is in play and something major will be released. Let’s hope the Treasury Department provides some PPP loan forgiveness guidance soon, which is rumored to be out at the end of this month. Speaking of that, Trout CPA has a webinar today at 10am which addresses this very topic.

The Dept. of Treasury did provide three updates yesterday related to the PPP loans. See below for the links to the documents and brief overviews:

- PPP FAQ, Question 37: Essentially, this is a rehash of FAQ 31. If you are owned by a private company and that private company has adequate sources of liquidity, then you may not be eligible for the PPP loan.

- Updated Interim Final Rule – Seasonal Employers: The update provided guidance on who the eligible lenders would be for seasonal employers. If a lender can do all other PPP loans, they can do them for Seasonal Employers.

- Interim Final Rule on Disbursements: This update provides some new guidance for lenders. A few things to know:

- A borrower cannot take multiple draws from a PPP loan. The disbursement must be one-time and in full.

- A loan is considered approved once an SBA loan number is received by the lender. A lender has 10 calendar days to disburse the loan.

- For loans that have not been fully disbursed prior to this rule, the lender has 10 days to complete the full disbursement starting as of April 28, 2020. The 8-week forgiveness period begins upon the first disbursement.

- Loans which have not been disbursed because the borrower has not submitted the required documentation within 20 days of loan approval shall be cancelled by the lender. (This seems to contradict the 10-day disbursement rule in 3b above; any guidance from my accountant friends would be greatly appreciated)

- When disbursing loans, lenders must send any amount of loan proceeds designated for the refinance of an EIDL loan directly to the SBA and not to the borrower.

Here are some other things that may be important or relevant for you:

- How do I handle the accounting for changes in leases if I am the lessor? FASB recently proved a helpful Q&A for lessors related to the accounting of deferrals of lease payments or modifications of leases. I know the document is a bit technical, but if you are a lessor, it may be important to understand and chat with your Accountant or internal finance lead about this topic.

- Upcoming Webinars and Helpful Resources

- Trout CPA: Making Sense of the Paycheck Protection Program Loan Forgiveness (4/29 @ 10am)

- US Chamber of Commerce Webinars

- Workshop Wednesday (4/29 @ 10:30am): Protecting Your Small Business from Cyberthreats.

- National Small Business Townhall (Friday 5/1 @ 12pm)

- NFIB Coronavirus Small Business Update (4/29 @ 12pm)

- RKL Weekly Webinar Series (Every Friday). To be added to their invite list, please click here.

April 29th, 2020: MPL General Counsel Corner – ….and now on the first tee

Just like the States are going through stages of reopening, its citizens are doing the same thing. However, I would liken it more to the 7 stages of grief (shock, denial, anger, bargaining, depression, testing and acceptance).

In Pennsylvania, many business owners are in the anger phase. The Auditor General announced yesterday that he would be looking into the Governor’s waiver process. Meanwhile, in response to a Supreme Court petition to halt enforcement of the stay-at-home order, Justice Alito has ordered PA to respond.

These are just a few examples of many citizen-driven actions that are popping up all over the Country. It will be an interesting next couple of weeks/months as the reopening phases roll forward.

With many States allowing more activities today, I hope that you can get out an enjoy what looks to be a nice weekend (at least in the Northeast). Here in PA, marinas and golf courses are finally open for business……and now on the first tee, hopefully, you.

Here are some other things that may be important or relevant for you:

- IRS Notice 2020-32, the battle lines are drawn: I read through this release a few times and it definitely cured my insomnia. However, it is important to understand that the language in this release seems to run counter to what is in the CARES Act. Chad Bumbaugh, from Stambaugh Ness, provided a good rundown:

- This notice disallows the tax deductions for wages, rents, utilities, and other expenses funded with forgiven PPP loans. While the CARES Act stated that forgiveness would not be includable in gross income the IRS, by denying these deductions, has made the forgiveness taxable, albeit indirectly. The forgiven PPP proceeds are not included in gross income but, because of the foregone deductions, end up in taxable income which is the most important of those two metrics.

- As it stands this seems to be “a case of two governmental agencies working against each other” as a colleague put it. Perhaps the parties will find a way to come together to revise the Code in a manner that more closely aligns with the spirt of the PPP loan detailed in the CARES Act.

- New PPP Interim Final Rule – Corporate Groups and Non-Bank and Non-Insured Depositary Institution Lenders –

- Can a single Corporate group receive unlimited PPP Loans? – Businesses that are part of a single corporate group cannot in the aggregate receive more than $20M in PPP loans. This rule applies to any loan that has not been fully disbursed as of 4/30/2020. If a Corporate Group has received funds that have exceeded this amount, they must notify their lender or they may forfeit loan forgiveness eligibility.

- Non-Bank and Non-Insured Depositary Institutions are eligible to be a lender in the PPP with certain conditions being met.

- Main Street Lending Program Update and Expansion: The Federal Reserve updated and expanded the Main Street Lending Program yesterday through revised term sheets and FAQ. This could be a good alternative to the PPP loan or EIDL program, albeit the terms are not as favorable. The basic additions are as follows:

- The program is now open to companies with up to 15,000 employees or $5B in revenue, versus the prior 10,000 employee and $2.5B in revenue threshold.

- A third lending option , the Main Street Priority Loan Facility(MSPLF), is available for lenders willing to share more of the burden with the Fed.

- For the Main Street New Loan Facility (MSNLF), the minimum size has been reduced to $500,000 from $1,000,000.

- For the Main Street Expanded Loan Facility (MSELF), the minimum loan size increased to $10M from $1M and the max loan size was raised to $200M from $150M.

- Upcoming Webinars and Helpful Resources

- RKL Weekly Webinar Series (Friday 5/1 @ 11am)

- US Chamber of Commerce Webinars

- National Small Business Townhall (Friday 5/1 @ 12pm)

- Stambaugh Ness Town Hall (Tuesdays 2-4pm)

April 30th, 2020: PPP Round 2 stats…more signs that a recovery is underway?

Hi Everyone:

PPP Round 2 stats were published by the SBA yesterday and the average loan size shrunk dramatically to $79k from $206k for all of Round 1. I wanted to see how the Round 2 numbers compared to Round 1. Below are some takeaways that I thought were interesting (FYI, I am attaching my spreadsheet so you can have the data as well).

- 90% of the approved loans thus far in Round 2 are <$150k per borrower, while they only accounted for ~37% of the total dollars approved.

- Total approved loans as of 5/3 are up 33% in Round 2, versus all of Round 1.

- Of the 5,432 lenders that participated in this round, 82% had less than $1B in assets, but only accounted for 21% of the total approved loans, 15% of the total approved dollars and had an average loan of $58K per borrower.

- Lenders with >$50B in assets accounted for ~3% of the lenders, ~47% of the total approved loans, ~53% of the total approved dollars and had an average loan of $90k per borrower.

- The States that had the biggest jump in approved loans and approved dollars as a percentage of the total in Round 2 versus Round 1 were as follows:

- CA: ~15% of approved loans (vs. ~7% in round 1) and ~19% of approved dollars (vs. ~10% in round 1)

- FL: ~8% of approved loans (vs. ~5% in round 1) and ~7% of approved dollars (vs. 5% in round 1)

- NJ: 3.5% of approved loans (vs. ~2% in round 1) and ~4% of approved dollars (vs. 3% in round 1)

- NY: ~7% of approved loans (vs. ~5% in round 1) and ~10% of approved dollars (vs. ~6% in round 1)

From the looks of things, the small banks are doing a lot more work this round given the number of approved loans. Also, some of the hardest hit States (CA, NJ & NY) are having the biggest jumps in businesses participating in the program.

With the recent warnings and updates from the Treasury Department and Secretary Mnuchin, I still hear of concerns from businesses and organizations about taking the PPP money. However looking at the numbers, the optimist in me says that businesses would not be taking on the risk of the PPP loan if they were not of the belief that things were improving.

Keep moving forward. Things will improve and hopefully return to some level of normalcy.

Here are some other things that may be important or relevant for you:

- MORE PPP FAQs (Questions 40-42): The Treasury Department provided more clarification for treatment of employee lay-offs, seasonal employer certifications and non-profit eligibility.

- Can a company in bankruptcy get PPP money? The rules say no. However, Rob Bovarnick (rmb@rbovarnick.com) of Bovarnick & Associates LLC reviews recent case law and brings up interesting points to consider.

- Upcoming Webinars and Helpful Resources

- Stambaugh Ness Town Hall (Tuesdays 2-4pm)

- NFIB Webinar – Getting Back to Business (Wednesday, 5/6 @ 12pm)

- RKL Weekly Webinar Series (Fridays): Click on this link to be added to the subscription list.

Please see all of our prior updates at the this link.