Understanding Title Settlement Fees

Title settlement fees have many components, and learning what they entail before you sign any binding agreement is essential. Title settlement is necessary for those buying residential and commercial real estate properties with or without a mortgage. It’s also vital when getting title insurance. Below, we discuss the possible expenses you may incur and how you can negotiate to save money.

What Is a Title Settlement Fee?

Title settlement fees are the administrative expenses associated with closing real estate transactions. It’s the money you pay to the title company to streamline the purchase and sale process and ensure the transfer of a good title. Title companies perform several beneficial functions, especially for those getting title insurance:

- Collecting and preparing legal documents such as title documents, deeds and transfer forms.

- Pairing the parties with the ideal title insurance company.

- Conducting the title search to identify and resolve defects.

- Advising parties on legal issues.

- Recording the deed transfer and mortgage documents.

- Witnessing and notarizing documents.

- Coordinating meetings.

- Collecting and disbursing funds to all parties.

- Preparing and distributing the completed closing packages.

Who Pays the Title Settlement Fee?

The buyer typically pays the title settlement fees as part of their closing costs. A common exception is a transaction involving a lender, where the buyer and seller may split the payment. It’s also possible for the parties to decide who pays, regardless of the usual expectation. For example, the parties can negotiate that the seller pays the title fees as part of seller concessions.

Seller concessions are the closing costs the seller agrees to pay. It can be complete or partial depending on the contract and generally covers the following:

- Title insurance: Protects the buyer or lender against financial losses resulting from issues with the property title.

- Loan origination fee: The fees lenders charge for processing loans.

- Appraisal fee: The expense you incur by getting a licensed third-party appraisal to determine the property’s market value.

- Recording fee: Covers expenses related to documenting the purchase at the local registry.

- Attorney fee: Covers the cost of hiring a real estate attorney.

Seller concession makes the property attractive to potential buyers. However, it’s essential to understand that sellers can only pay a limited amount, so the buyer must negotiate carefully.

How Much Is a Title Settlement Fee?

The cost of title settlement varies from case to case, depending on factors like the title search, escrow, closing and professional fees. Let’s dive deeper to see what each covers:

- Title search: Covers costs you incur on things like surveys, search reports, abstract of title and other administrative expenses.

- Escrow fees: The expenses you incur for having an escrow agent, attorney or title company to hold and distribute monies pertaining to the real estate transaction at closing.

- Closing fees: The expenses you may incur at the end of the real estate transaction. They may include administrative costs for title insurance or settlement services.

- Professional Services: The money you pay to professionals like real estate attorneys, notaries and surveyors. Attorneys’ fees, for example, may cater to deed preparation, title searches and legal advice.

- Miscellaneous: Covers related expenses like application and recording fees.

What Are the Different Categories of Title Insurance Costs?

There are two different categories of title insurance fees you should understand.

1. Owner’s Title Insurance

The coverage protects the property buyer against financial losses arising from an undetected title defect, such as:

- Estate and family issues: Title insurance can protect you against many estate and family issues arising from divorces, undisclosed heirs and conflicting wills.

- Deed errors: Errors in deed instruments can interfere with the owner’s rights and interests, making it essential to purchase title insurance.

- Encumbrances: A person’s right — other than ownership interests — affects the property. Examples include easements and restrictive covenants. An easement is the right of another person to use your land, while a restrictive covenant is a clause in the conveyance that prohibits or restricts you from using the property in a certain way.

- Liens: A lien is the right of a person — typically a creditor — to assert claims against a property due to an undischarged obligation. The lienholder can apply to a court to seize and sell your property unless the debt is paid. There are different types of liens, including mechanics, tax and mortgage liens.

- Falsified documents and identification: Fraud and forgery through impersonation, creation of fake documents or any other deceptive means can invalidate the transaction, so it’s best to get title insurance for added protection.

Owner’s title insurance is optional but crucial, considering the protection it offers. Besides providing coverage for possible title defects, it also tries to mitigate the risk altogether.

2. Lender’s Title Insurance

The coverage protects lenders against adverse claims on the property. It’s mandatory for real estate properties secured by a mortgage and safeguards the lender’s mortgage or lien in terms of its priority, validity and enforceability.

You can purchase lender’s title insurance in a bundle with owner’s title insurance, typically for less. It’s a one-time premium like owner’s title insurance and is charged as a percentage of the sale price. The lender’s title insurance covers the life of your loan, so you may need to purchase a new coverage if you refinance.

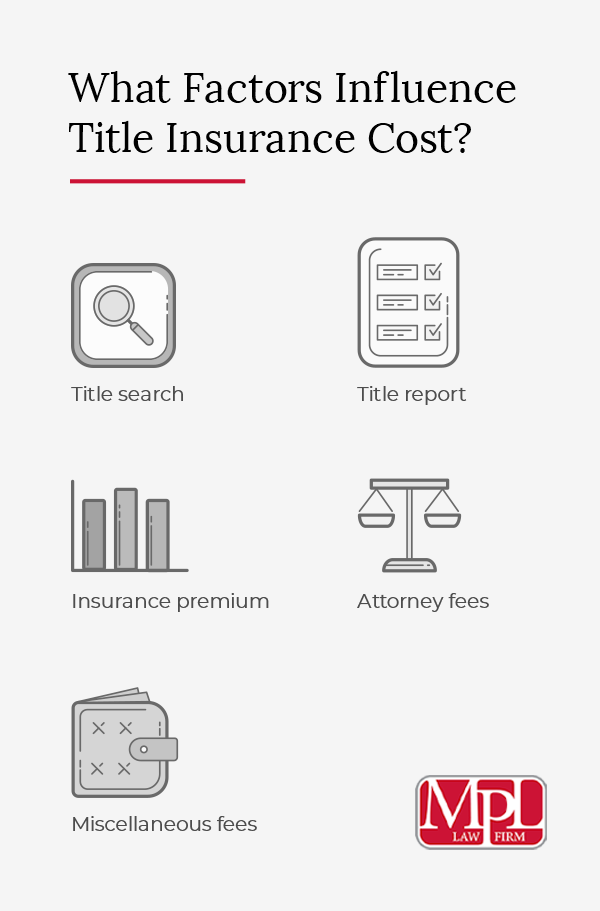

What Factors Influence Title Insurance Cost?

The cost of title insurance has several components:

- Title search: The cost of the examination conducted to ascertain whether the seller’s title to the property and the right to convey same to the buyer.

- Title report: The cost of the documented outcome of the search report providing information such as the current owner, property description and encumbrances.

- Insurance premium: The one-time premium paid at closing.

- Attorney fees: Costs for the attorney services, search as title examination and preparation of legal documents.

- Miscellaneous fees: Associated expenses such as settlement and filing fees.

The premium you pay for title insurance also varies from case to case and is influenced by the following:

- Property value: Different factors affect property value, including the location, size and overall condition. High-valued properties typically attract high premiums, considering the risk value.

- Property type: Commercial properties usually attract higher premiums since they often cost more. However, there are instances where residential real estate properties have higher values.

- Property history: The amount of work necessary to obtain accurate information and the potential risk associated with the property can determine your premium. Properties with clean, consistent title histories often attract lower premiums.

- Extended coverage: Purchasing additional protection beyond the standard coverage increases the insurance premium. A classic example is when you get extended coverage to cater to increased property value.

What Is a Loan Estimate?

A loan estimate is a standardized form providing necessary financial information about the mortgage, including the estimated interest rate, closing costs and monthly payment. It helps the borrower know what to expect going into the loan agreement with the lender.

Previously, the lender was required to provide two documents — the Truth-in-Lending Act statement (TILA) and the good faith estimate (GFE). TILA contained the written disclosures, while GFE provided basic information about the terms of the mortgage loan offer. These two documents are now combined into one to form the loan estimate.

A standard loan estimate contains the following information:

- Loan terms: Includes information like the loan amount, interest rate, repayment penalty and balloon payment. Remember, these details are only relevant for properties secured by a mortgage.

- Projected payments: The total amounts covering things like the principal and interest, estimated escrow, and mortgage insurance.

- Loan costs: The administrative costs the borrower incurs on things like application, underwriting, credit reports and title-related services.

- Closing costs: A percentage of the purchase price or loan amount charged for closing the transaction. The amount you pay depends on the type of loan and its purpose.

- Other costs: Associated costs like taxes and other government fees, initial closing escrow payment and any prepaid items.

It’s vital to remember that the loan estimate is not the same as a loan approval. It estimates what the borrower should expect going into the loan agreement, which can change depending on the situation. The document provides other essential information, such as the name and address of the loan applicant, the date issued, the property address and the sale price.

What Is the Impact of Title Settlement Fees on Buyers and Sellers?

Title settlement fees bring additional costs to buyers while reducing sellers’ net proceeds. However, considering how crucial title settlement is in the property acquisition process, it helps both parties to prepare and plan ahead of time.

A practical solution is partnering with a full-service title settlement company with experience closing residential and commercial real estate transactions. This way, you can lower costs while getting efficient and comprehensive services. The parties must also negotiate and share the cost-effectively to balance their financial responsibilities. The interest of both parties is to streamline and facilitate closing, so it’s best to collaborate.

Work closely with your real estate attorney or settlement agency to understand the specific settlement fees you may incur and those you can trade to help close the transaction. Additionally, carefully review the closing statement, loan estimate and other documents before signing. You want to ensure the information is accurate and the costs are correctly apportioned before concluding.

Can You Negotiate Title Insurance and Settlement Fees?

Some aspects of the title insurance and settlement fees are negotiable, while others are typically non-negotiable. Knowing the difference can help you cut down costs.

1. Negotiable Fees

These are the negotiable title insurance and settlement fees:

- Origination fees: Covers the cost of underwriting the loan. The origination fee is a percentage of the loan amount, but you can negotiate for a reduction or complete elimination.

- Discount points: The upfront fee for a reduced interest rate on your mortgage loan. It’s calculated as a percentage of the total loan amount.

- Title search fee: The cost you incur on the title search before getting title insurance. The examination helps you identify title defects on the property.

- Title insurance premium: The one-time premium paid to the insurance company at closing. The amount is negotiable, but ensure adequate coverage to safeguard your interest.

- Underwriting fees: The amount you pay the underwriter for verifying your income, assets, debts and property details before approving the loan. The lender may replace this with the origination fees, but you can negotiate to reduce the amount.

- Real estate commissions: The commission paid to real estate agents for their services. The seller is usually responsible for paying the fee but can negotiate to reduce the amount.

- Loan application: The one-time fee paid to the lender for processing and underwriting the loan. You can negotiate with the lender, especially when making other substantial payments.

2. Non-Negotiable Fees

Below are the fees that are typically non-negotiable in title insurance and settlement transactions:

- Appraisal fees: The money you pay for having an appraiser evaluate the property to determine its fair market value. The buyer typically pays this fee.

- Credit check fees: The costs associated with credit checks before the lender issues or approves the loan. It helps the lender determine the rate and repayment terms. Although it’s typically non-negotiable, lenders sometimes cover the fee themselves.

- Government charges: The money you pay to the government to cover things like title transfer and filing. Government charges also include property taxes.

Tips for Effective Negotiation

Negotiating with the buyer, seller, lender, settlement company or insurer is necessary to gain a financial advantage. It’s a skill learned through practice and experience, but the following tips can help you succeed:

1. Prepare

Always prepare before going into a negotiation. Research the other parties and identify areas where you can cut costs. Again, always set your best alternative to a negotiated agreement (BATNA) or worst alternative to a negotiated agreement (WATNA) beforehand. The BATNA is the most advantageous alternative you can take if negotiations fail, while the WATNA is the worst possible result you would take if negotiations fail.

2. Listen Carefully

Resist the urge to interrupt the other party while they’re talking. Remain calm and allow them to share their opinions. This approach will enable you to determine what’s most important to them and what they’re willing to compromise. Listening carefully lets you ask the right questions and establish a lasting bond with your counterpart.

3. Work With the Parties

Work with the parties to find a favorable outcome. Remember, each party wants their interests protected, so you must collaborate to find a practical solution. Use your leverage wisely and be respectful throughout the process.

You can compare prices to gain a good understanding of the market and help you make an informed decision. Finally, prioritize the most critical expenses and use them to negotiate seller concessions. Making smart tradeoffs will enable you to get value for your money.

4. Leverage Other Professional Services

You can consider full-service title settlement companies and negotiate to get multiple services for a reasonable fee. For example, if the settlement company is a real estate law firm, they may conduct the title search, underwrite the loan, prepare the necessary documents and provide legal advice, which is more beneficial than hiring different companies for each process.

MPL Law Firm Is Your Trusted Real Estate Professional

MPL Law Firm is a full-service, relationship-based real estate transactional firm in York, Pennsylvania. We underwrite home title insurance for Stewart Title and Guarantee Company through our licensed settlement company, MPL LandServices, LLC.

We are dedicated to understanding our clients’ needs and helping them streamline the settlement process. If you want to learn about our services, contact us now.