MPL General Counsel Corner – PPP guidance is like the weather, if you don’t like it, wait five minutes.

During this time of year, if you don’t like weather, wait five minutes. Well, I feel the same way about PPP and other relief programs. Late Friday, the Department of Treasury released the following two Interim Final Rules (key points/updates listed below each link):

- IFR – Loan Forgiveness

- The Lender has 60 days from receipt of the loan forgiveness application to issue a decision to the SBA (change from what I heard prior to 5/22) and request payment from SBA. (page 7)

- The SBA, subject to any audit, has up to 90 days to issue payment and any applicable interest less EIDL Advance Amounts (change from what I heard prior to 5/22; page 7)

- Upon receipt of a decision/payment from SBA, Lender then notifies Borrower of the decision and whether the balance of the loan must be paid on or before the two year maturity date (big change because it opens the door for the Lender to call the loan earlier than the maturity date; page 8)

- The SBA & the Department of Treasury clarified and provided more flexibility for employers that have different payroll periods (e.g., weekly, monthly, bi-weekly). Essentially, the borrower’s eight-week period begins on the first day of the first payroll cycle in the covered period (see example on page 10).

- Hazard pay and bonuses are allowed to be paid to employees as long as the annual salary of does not exceed $100,000 (as prorated for the covered period; $15,385 for 8 weeks; page 11)

- Non-payroll costs incurred but paid on the next billing cycle which is outside the covered 8-week period are eligible for forgiveness (see example on page 12).

- Advance payments of eligible mortgage interest are not eligible for forgiveness.

- Clarifications on the definition of Full Time Equivalent, the impact of Salary Reduction, attempts to rehire laid off employees who do not want to return, and employees who are fired for cause, voluntarily resign or request a schedule reduction (pages 13-22)

- IFR – SBA Loan Review Procedures and Related Borrower and Lender Responsibilities

- The SBA may review any PPP loan of any size at their discretion. (page 7)

- The borrower must retain documentation for the PPP loan for 6 years after the loan is forgiven or paid back in full. (page 8)

- If the SBA determines a borrower was ineligible to receive a PPP loan or receive PPP forgiveness, there will be an appeals process. The appeals process will be outlined in a subsequent IFR. (page 10)

- If the Lender determines that the Borrower is not entitled to forgiveness in any amount, they must notify in writing the SBA and the Borrower with its reason. The Borrower has 30 days from the denial to request a review of the forgiveness application. (page 13)

- If the SBA determines a Borrower is ineligible for a PPP loan and the lender had already approved it, the Lender’s processing fees are subject to a claw-back. The timeframe for the SBA to make this determination is 1 year from the date of the PPP loan disbursement. (page 15)

- If an SBA lender does not satisfy its obligations under the PPP regulations, then its lender processing fees are subject to a claw-back and the accompanying loans may lose its SBA guarantee. (page 16)

Here are some other things that may be important or relevant for you:

- PA Updates Green Phase – While some counties are moving to green in the coming weeks, they will be subject to different restrictions than were originally provided. By June 5th, all counties in the State are supposed to be at Yellow or Green.

- Upcoming Webinars and Helpful Resources

- KMRD Partners’ Return to Work Action Webinar (5/27 @ 10am; thanks to Doug Berman from RKL for bringing it to our attention)

- PPP Forgiveness & Cashflow Link

- Trout PPP Forgiveness Webinar Links:

- NFIB PPP Loan Forgiveness Webinar Links:

Please see all of our prior updates at this link or if you would like to be added to our email list, please click here.

As always, please don’t hesitate to email myself (jsanders@mpl-law.com), Andy Miller (amiller@mpl-law.com), Christian Miller (cmiller@mpl-law.com) or anyone in our office with questions or comments.

May 2020 – Covid-19 Legal Update Archive

- May 05, 2020 – FEAR – What will you do?

- May 06, 2020 – MPL General Counsel Corner – Good Old-Fashioned Political Pissing Match

- May 7, 2020 – MPL General Counsel Corner – Time to shift a bit – Focus more on Reopening & Recovering

- May 8, 2020 – Post-Covid Questions to Ponder

- May 11, 2020 – MPL General Counsel Corner – PPP Funds Still Available, If You Need Them

- May 12, 2020 – MPL General Counsel Corner – Who among you will be the next Disney, FedEx or Microsoft?

- May 13, 2020 – MPL General Counsel Corner – A Collective Sigh of “PPP Good Faith Certification” Relief

- May 14, 2020 – MPL General Counsel Corner – Stimulus Round 4 – HEROES Act – DOA

- May 15, 2020 – MPL General Counsel Corner – Legal Battles Continue

- May 16, 2020 – MPL General Counsel Corner – And now for your reading pleasure…PPP Forgiveness Guidance

- May 18, 2020 – MPL General Counsel Corner – Maybe I am forecasting and I don’t know it!

- May 19, 2020 – MPL General Counsel Corner – PPP Round 2 Funds Availability Increasing, not Decreasing

- May 20, 2020 – MPL General Counsel Corner – Happy House Hunting in PA this Weekend

- May 21, 2020 – MPL General Counsel Corner – What does re-opening look like?

- May 22, 2020 – MPL General Counsel Corner – PPP Loan Forgiveness – A Tale of Two Cities

- May 27, 2020 – MPL General Counsel Corner – Things Must Be Moving To “Normal”

- May 28, 2020 – MPL General Counsel Corner – Just the facts, Ma’am

- May 29, 2020 – MPL General Counsel Corner – PPP Recipients Get A Potential Lifeline

May 05, 2020 – FEAR – What will you do?

As a leader of a business or organization, you have the power to choose which way you want to handle a crisis. Are you going to put your head in the sand and hope for a recovery or do something about it proactively to improve your chances for survival?

As I have read on the Internet (so, it must be true), FEAR has two meanings:

Forget Everything And Run

or

Face Everything And Rise.

I think these acronyms are important reminders of how you make decisions about the direction of your business or organization. Are you playing offense, defense or a mix of both? What are you doing to better position your business or organization for the recovery? How are you handling your business or organizational FEAR?

If you need some guidance, check out a good article that I recently read from the Harvard Business Review. It talks about shifting your organization from panic to purpose.

You don’t have to choose to participate in a downturn.

Here are some other things that may be important or relevant for you:

- PPP & Bankruptcy – More Analysis – While I hate to see businesses do this, it is an unfortunate reality. Check out the latest bankruptcy case law analysis from Rob Bovarnick (rmb@rbovarnick.com) of Bovarnick & Associates LLC.

- Upcoming Webinars and Helpful Resources

- Stambaugh Ness Town Hall (Tuesdays 2-4pm)

- NFIB Webinar – Getting Back to Business (Wednesday, 5/6 @ 12pm)

- RKL Weekly Webinar Series (Fridays)

May 06, 2020 – MPL General Counsel Corner – Good Old-Fashioned Political Pissing Match

The great debate over the deductibility of the PPP related expenses rages on. After the IRS issued guidance last week related to this topic, business owners were left further confused about whether PPP funds, if properly used, were fully forgivable or not.

It appears this frustration has bubbled up to Congress as top tax writers from both sides of the aisle in the House and the Senate have expressed their disapproval and intent to fix it. Never one to back down from a fight, Secretary Mnuchin doubled down in support of the IRS interpretation.

Looks like we have a good old-fashioned pissing match between two branches of the Federal Government. Let’s hope the small business community does not end up being battered and bruised as a result.

Here are some other things that may be important or relevant for you:

- PPP Fraud Round 1: The DOJ announced the first PPP related fraud case yesterday. I can guarantee you this will not be the last such case. (thanks to Chad Bumbaugh from Stambaugh Ness for sharing)

- How do I know if my county/region in PA will be moving into the next reopening phase? Technically, your region must have 50 new cases or less per 100,000 people for 14 days to move into the next reopening phase. However, after an exhaustive search, it has been tough to find the data on the PA Government websites to show this trend.

- Joel Berg, in his latest BizNewsPA update, was on the case and found a great third-party website to give you just that insight. For the data wonks out there, enjoy!

- Updated PPP FAQ (Questions 43 & 44):

- Question #43 extended the “return the funds” due date to 5/14 for those companies that may be uncertain if they comply with good faith certification. They are also intending to release additional guidance on how it will look at these good faith certifications prior to the 5/14 date. Lets hope they stick to this commitment.

- Question #44 clarified the accounting for employees of international companies in relation to the PPP application.

- New PPP Interim Final Rule on non-discrimination and student employees was also released. While its nice they are clarifying these issues, the big one we are all waiting for is on forgiveness guidance.

- NJ Governor says there is no timetable to reopen NJ Coronavirus lockdowns…..whether you like it or not! As much frustration as I hear about PA’s plans, I am glad this tone is not being used here….yet.

- Upcoming Webinars and Helpful Resources

- NewsTalk 93.9 & 910 WSBA Interview: Thanks to Gary Sutton for having me on his show this morning to talk about small businesses and how they may function in a post-Covid environment.

- Reopening PA – The PA Chamber recently launched bringingpaback.com to help PA business reopen. It lists all the reopening initiatives by county as well as policy support statements and resources.

- NFIB Weekly Webinar: Here are the links to the presentation and the slides from today’s webinar

May 7, 2020 – MPL General Counsel Corner – Time to shift a bit – Focus more on Reopening & Recovering

Businesses around the country are starting to reopen and some are doing it in defiance of Governor’s mandates. A salon owner in TX was jailed (and ultimately released) for violating a lock down order, while two PA based businesses (another salon and a gym) are back to serving customers in open defiance of the Governor’s shutdown. The US Supreme Court also denied an emergency petition to reopen businesses in PA on Wednesday.

The momentum to open versus lock down is certainly accelerating. As a result, I want to shift a bit to share more updates on topics around reopening and recovering. Hopefully, these additions to our updates will spur some additional thought for you.

Here are some other things that may be important or relevant for you:

- Perhaps Business Owners Should Think About Some Estate Planning – Brian Luster from Collective Family Office provides a great overview of some Estate Planning topics to think about in the current low interest rate environment.

- New Guidance on Worksharing from the Department of Labor – Tedd Kochman from Littler provides a good recap and updated DOL guidance around the Short Time Compensation (i.e., worksharing) provisions of the CARES Act. It may be a good way to bridge the gap from lay off to full time employment.

- Updated PPP FAQ (Questions 45): Essentially, this clarification says that if a business returns the PPP loan in full by 5/14/2020, then they are eligible for the Employer Retention Tax Credit.

- Economic Indicators and Market Stats: Larry Moskowitz, Certified Financial Services, shared the weekly economic indicator update from JP Morgan Asset Management. FYI, the NASDAQ is close to being positive for the year.

- Upcoming Webinars and Helpful Resources

- Reopening PA – I sent out a link yesterday which did not work. It is the PA Chamber’s bringingpaback.com website to help PA business reopen. It lists all the reopening initiatives by county as well as policy support statements and resources.

May 8, 2020 – Post-Covid Questions to Ponder

As I move from one zoom call to the next, I am hearing some common questions:

- What does a post-Covid world look like and how does my business or organization fit in?

- What should I be doing now to get my business or organization ready?

- Will things ever get back to normal?

I wish I could answer those questions for you, but I can’t. Only you can do that. All I can tell you is that when you think through questions like above and other deeper topics, it is important to know that you can tap into your mentors and other professional advisors for guidance. I think the quote below is appropriate.

“Our greatest weakness lies in giving up. The most certain way to succeed is always try just one more time.” – Thomas Edison

Speaking of post-Covid thinking, check out the latest update from Chad Harvey (What Comes Next? Covid-19 Facts and Their Implications). I think it provides a nice framework to help you to work on, and not just in, your business or organization.

Here are some other things that may be important or relevant for you:

- Employee Retention Tax Credit: I received a number of questions related to the Employee Retention Tax Credit (because of yesterday’s release of Question 45 of the updated FAQ). Check out Trout CPA’s article, Tax Relief Provided By The CARES Act – Business Provisions, detailing how it works.

- PA Governor Wolf Extends the Stay At Home Order for Red Regions until June 4th. While 24 counties got the “get out of jail…a little” card today, the remainder of the State remains on lockdown. Let’s hope the June 4th date gets pulled forward for more counties. There will be a further update this afternoon at 2pm. Stay tuned.

May 11, 2020 – MPL General Counsel Corner – PPP Funds Still Available, If You Need Them

The US Department of Treasury only provided two updates related to the PPP over the weekend. We are still awaiting the Loan Forgiveness guidance.

The first was a procedural update related to the extension of the deadline to give back the PPP funds to May 14th. More interesting was the latest loan numbers as of 5/8.

The total amount of funds approved is now ~$189B, which is 61% of the total amount approved ($310B) and only a slight uptick from the prior week’s reported level of ~$176B. On top of that, the average loan per borrower has dropped further to ~$73k from ~$80k in the prior week’s report, while the approved loans are up 55% from all of round 1 levels, versus up 33% as of the first round 2 PPP update. (see my PPP_Round_2.02t for more data).

While I cannot say for certain, a good theory for the slow loan growth in spite of the accelerated application growth is the return of funds by recipients from round one or early in round two. Importantly, if you have not applied yet, it looks like there are going to be funds available as long as you need the money.

Here are some other things that may be important or relevant for you:

- 30% Rule Helped Apple, Maybe It Can Help You. I thought Steve Jobs did a “pretty good” job turning Apple around. Perhaps the 30% rule described in the Inc.com article could be a good guide for your business.

- Mutiny of the Counties – Check out the latest update from Joel Berg at biznewsPA. He provides a good overview of the various counties and officials in Central PA that are choosing to go against the Governor’s orders.

- The Great Tug of War – Check out the latest economic and market update from Robert Teeter at Silvercrest Asset Management Group (thanks to Sean O’Dowd for sharing).

- Upcoming Webinars and Helpful Resources

- Stambaugh Ness Town Hall (Tuesdays 2-4pm)

- NFIB Weekly Webinar (5/13 @ 12pm)

- RKL Weekly Webinar Series (Fridays): Last week’s webinar provided some helpful insight into PPP loan forgiveness forecasting and cash flow modeling and some other informative tips for opening up.

- Trout CPA has just updated their PPP FAQ page.This is a very comprehensive list of questions as you navigate the PPP landscape.

May 12, 2020 – MPL General Counsel Corner – Who among you will be the next Disney, FedEx or Microsoft?

What do GE, GM, IBM, Disney, HP, Hyatt, Trader Joe’s, FedEx, Microsoft, and Electronic Arts have in common? Outside of being large (at one point in time) public companies, they were started during a Recession.

There are things that you can be doing right now that could pay dividends for you and your business as we move past the current crisis. As the leader of your business or organization, you have probably spent a lot of time lately working in your business.

However, the key to long term success is to also be working on your business.

The big question is how do you do shift when everything seems to be collapsing around you? Check out some of the articles below for ways to frame this critical concept:

Working On vs. In Your Business

For Savvy Entrepreneurs, an Economic Downturn Creates Opportunity

You Can Beat the Next Recession: Here are 5 Companies That Did Just That

The E-Myth Principle is Still Alive and Flourishing

Who among you will be the next Disney, Fedex or Microsoft?

Here are some other things that may be important or relevant for you:

- Upcoming Webinars and Helpful Resources

- Stambaugh Ness Town Hall (Tuesdays 2-4pm)

- US Chamber of Commerce

- Workshop Wednesday (5/13 @ 10:30am): Building New Workplaces for the Post-Pandemic World

- US General Services Administration Webinar (5/13 @ 4pm) to help Small Businesses pursue opportunities to support and sell to the Federal Govt.

- National Small Business Town Hall (5/15 @12pm)

- NFIB Weekly Webinar (5/13 @ 12pm)

- RKL Weekly Webinar Series (Fridays): Last week’s webinar provided some helpful insight into PPP loan forgiveness forecasting and cash flow modeling and some other informative tips for opening up

May 13, 2020 – MPL General Counsel Corner – A Collective Sigh of “PPP Good Faith Certification” Relief

The Treasury Dept. released an updated PPP FAQ with Question #46 added. Essentially, if you borrowed less than $2M, you are deemed to have met the Good Faith Certification on the need for the loan. For those who received >$2M, they are still subject to SBA review on a case by case basis. Importantly, if you are in the >$2M spectrum and there is a determination that you did not meet the good faith standard, then you can pay the funds back without any further enforcement action or referral to other agencies.

This is good news for those that were nervous about receiving the PPP funds. We can all breath a collective sigh of “PPP Good Faith Certification” relief.

Now, it is on to the PPP Forgiveness clarifications. Let’s hope that comes out soon.

Here are some other things that may be important or relevant for you:

- COVID-19 REGULATORY AND LEGISLATIVE ACTIVITY TRACKER – The National Council on Compensation Insurance has a great resource highlighting key Covid-19 legislation and regulation activity on a State by State basis.

- Updates on State Re-openings

- NJ to Reopen nonessential stores for curbside pickup, allow construction as coronavirus outbreak slows. (This story was shared by Tedd Kochman from Littler).

- Rural Areas Reopen Around U.S. Cities Still Stuck on Lockdown.

- More Fund Usage Flexibility for Small Business PPP Recipients on the Horizon? Secretary Mnuchin is open to it.

- Upcoming Webinars and Helpful Resources

- RKL Weekly Webinar Series (Friday, 5/15 @ 11am)

- Designing the Pivot and Staying Mentally Tough (5/14 @ 11am) – This may be a good webinar for those of you “working on” your business (presented by Inc.com)

- US Chamber of Commerce

- US General Services Administration Webinar (5/13 @ 4pm) to help Small Businesses pursue opportunities to support and sell to the Federal Govt.

- National Small Business Town Hall (5/15 @12pm)

- Stambaugh Ness Town Hall (Tuesdays 2-4pm)

May 14, 2020 – MPL General Counsel Corner – Stimulus Round 4 – HEROES Act – DOA

The House Democrats released their version of Stimulus Round 4, the Health Economic Recovery Omnibus Emergency Solutions Act (aka, HEROES Act), earlier this week. It is a $3 Trillion plan that includes funding for state and local governments ($1 Trillion), funds for hazard pay for employees ($200B), funds for mail-in ballots ($3.6B), modifications to the PPP program (extension of the covered period and time to use the funds) and more. The Act also expands eligibility in the non-profit sector to all 501(c) organizations, not just 501 (c)(3)’s.

The Senate and the President have already expressed the HEROES Act is DOA because it does not include liability protection for companies. The mail-in ballot funding was also mentioned as a non-starter.

In DC it is business as usual, lets hope the private sector is afforded the same privilege.

Here are some other things that may be important or relevant for you:

- Interim Final Rule – Loan Increases – Last night the Treasury Department provided guidance for Partnerships and Seasonal Employers who applied for and received loans under criterion that have since been updated.

- Partnerships: If a Partnership received a PPP loan and did not include a Partner’s compensation, the Lender is authorized to increase the loan amount to cover the Partner’s compensation.

- Seasonal Employers: If a seasonal employer received a PPP loan under the original criterion and the revised criterion would have resulted in a larger loan, then the Lender is authorized to increase the loan amount.

- In both cases, the Lender is still subject to the reporting requirements to the SBA and the additional amounts must still conform with current PPP standards.

- PPP FAQ #47 – Given the last minute release of the Good Faith clarification, the Treasury Department has extended the time frame to return the funds to 5/18 if you believe you cannot meet the certification.

- PA Supreme Court Case Ruling Unfriendly to Insurance Carriers: The Friends of Devito ruling could be used to deny insurance company’s ability to issue blanket coverage denials to businesses who sustained massive losses due to forced closures by executive orders. (thanks to Scott Rogers from the Southwest Insurance Agents Alliance for sharing).

- More Pushback on Stay at Home Orders – The Wisconsin Supreme Court struck down the Governor’s shut down order. This ruling is groundbreaking because for the most part, Courts have sided with Governors on this issue.

- Upcoming Webinars and Helpful Resources

- Designing the Pivot and Staying Mentally Tough (5/14 @ 11am) – This may be a good webinar for those of you “working on” your business (presented by Inc.com)

- US Chamber of Commerce: National Small Business Town Hall (5/15 @12pm)

- EisnerAmper – Insurance Recovery for Pandemic Losses: Issues and Options (5/20 @ 2:15pm)

May 15, 2020 – MPL General Counsel Corner – Legal Battles Continue

As we get further into this process, more and more legal battles continue. We let you know about the Wisconsin Supreme Court case yesterday. Also, I am hearing more and more about legal challenges to insurance coverage. In fact, the PA Supreme Court has recently said that they are refusing to fast track any Covid related business insurance challenges. Check out the latest update from Rob Bovarnick (rmb@rbovarnick.com) of Bovarnick & Associates, LLC. This will only get more heated as the economy reopens.

Not a lot else on the updates today. We expect PPP forgiveness clarification from the Department of Treasury any day.

Here are some other things that may be important or relevant for you:

- Interim Final Rule on Eligibility of Certain Electric Cooperatives – Unless you are in this business, it may not be totally relevant for you. However, if you bounce back and forth from profit to non-profit, it could provide some guidance.

- Upcoming Webinars and Helpful Resources

- US Chamber of Commerce: National Small Business Town Hall (5/15 @12pm)

- EisnerAmper – Insurance Recovery for Pandemic Losses: Issues and Options (5/20 @ 2:15pm)

May 16, 2020 – MPL General Counsel Corner – And now for your reading pleasure…PPP Forgiveness Guidance

The SBA & Dept. of Treasury finally released the PPP forgiveness application. I’d love to take credit for the overview but could not do much better than Chad Bumbaugh and the Stambaugh Ness team. See below for their overview:

“The guidance arrived in the form of the loan forgiveness application announced with this press release late yesterday afternoon. I’ve provided below an overview of the application contents as well as some commentary from me (in bold) from my early reactions to the application. We’ll be assessing the guidance and any further information that comes out internally so take the bold comments as my “hot takes” only for now please. Overall, my opinion is that there are some welcomed simplifications to the requirements, one potential negative around owner’s compensation, and several items still without definitive guidance.

- Pg. 1 – Forgiveness application requires the PPP Loan Forgiveness Calculation Form (starts on pg. 3) and the PPP Schedule A (for calculating FTE and wage limitations, this starts on pg. 6).

- Application also includes PPP Schedule A worksheet to help with completing the form and an optional PPP borrower demographic information form (notes that there is no impact from not completing form)

- Pg. 1 – Alternative payroll covered period detailed on first page should alleviate need for off-cycle payrolls when combined with definition of eligible payroll costs on pg. 3. Great news!

- Pg. 2 – interest costs guidance for forgiveness emphasizes “mortgage”. Other interest costs now not permissible?

- Pg. 2 – Defines eligible payroll costs – of note payroll costs incurred but not paid during the borrower’s last pay cycle of covered period (or alternative covered period) are eligible for forgiveness if paid on or before the next regular payroll date.

- Pg. 2 – Eligible nonpayroll costs

- No guidance on any further utilities being eligible – remains the same list as previously

- Notes that all eligible nonpayroll costs must be paid during the covered period OR incurred during the covered period and paid on or before the next regular billing date, even if the billing date is after the covered period. Big positive – this should largely eliminate need for splitting invoices for things like health insurance since it’s unlikely the monthly invoice aligned perfect to the covered period.

- Pg. 3 – Forgiveness ordering of “haircuts” 1) salary/hourly wage reduction, 2) FTE headcount reduction and finally 3) 75%/25% payroll/nonpayroll. This is different than prior consensus but favorable.

- Pg. 4 – Notes that payroll for any one individual is capped at $15,385 per individual ($100k / 52 weeks * 8 weeks) – seems to eliminate need to annualize compensation. Another positive.

- Pg. 5 – Details line by line items on the forgiveness form – note still not much specific guidance providing on calculating eligible retirement expenses.

- Pg. 5 & 6 – compensation to owners is listed separately from employee pay. Instructions to line 9 on pg. 5 note that owners comp capped at $15,385 or the eight-week equivalent of their applicable compensation in 2019, whichever is lower. I read the intent of this as a limit on bonuses and other compensation to owners if not comparable amounts of bonuses in same time period in prior year. This could be the biggest negative in the additional guidance.

- Pg. 7 – FTE defined as 40 hours (not 30 hours as under ACA method previously speculated). Also provides an optional simplified method to count any employee < 40 hours as 0.5 FTE regardless of hours worked.

- Other than changing spreadsheets that may have been developed to calculate FTE’s don’t see much impact of move to 40 hour FTE assuming same measurement technique used to measure base FTE’s and covered period FTE’s.

- The simplified method to calculating part-time employees as 0.5 FTE may become an important planning point for some businesses.

- Pg. 7 – Details the salary/wage reduction calc and the exception to reduction to complete the PPP schedule A worksheet on pg. 9

- Pg. 8 – Details the FTE reduction calc and the related safe harbor also to complete the PPP Schedule A worksheet on pg. 9

- Exceptions expanded to include not just employees who denied attempt to rehire but also those a) fired for cause, b) voluntarily resigned, or c) voluntarily requested and received reduction in hours. Adjustment made for any of these situations if position was not filled by new employee.

- Pg. 10 – Provides list of documents that must be submitted with PPP loan forgiveness application and what is required to be maintained, but not submitted. Based on experiences with the application process it is likely lenders will each have slightly different interpretations on some of these items.

- Pg. 11 – optional demographic disclosure form – as mentioned above it is noted that this won’t impact forgiveness if not completed”

Here are some other things that may be important or relevant for you:

- PA Moves More Counties to Yellow: Here is a guide for businesses in those areas.

- Upcoming Webinars and Helpful Resources

- Stambaugh Ness Town Hall (Tuesdays 2-4pm)

- RKL Weekly Webinar Series (Fridays)

- EisnerAmper – Insurance Recovery for Pandemic Losses: Issues and Options (5/20 @ 2:15pm)

May 18, 2020 – MPL General Counsel Corner – Maybe I am forecasting and I don’t know it!

In my weekend reading, I came across the following quote from noted Economist John Kenneth Galbraith that I thought was appropriate given the current situation:

“We have two classes of forecasters: Those who don’t know – and those who don’t know they don’t know.”

As we progress through the current situation, I am sure you will agree that the forecasters have somewhat missed the mark as it relates to Covid infection rates, deaths, hospital utilization and so on. I am not making the statement to criticize their efforts, but merely to point out that you can only control what is right in front of you.

If you continue working on your business, talking with your personal Board of Directors and using your professional advisors, I would bet that you will come out the other side of this crisis in a much better position. Then again maybe I am forecasting and I don’t know it.

Keep moving forward, things will get back to normal.

As a reminder, if you are planning to return the PPP funds without any further obligations (i.e., as if you never received them), today is the last day to do it.

Also, for those that are approaching the end of your PPP initial 8 weeks, here is the loan forgiveness application. There are several PPP Loan Forgiveness webinars that are coming up. I have listed them in the bullet points below.

Here are some other things that may be important or relevant for you:

- Interim Final Rule – Treatment of Entities with Foreign Affiliates – This update essentially clarifies the employee count confusion that arose from the PPP FAQ update from 5/5. Under this rule, if you applied for the PPP before 5/5 and only used your US-based employees and were under the 500-employee count threshold, you will still be eligible for the PPP funds. However, if you applied after 5/5, then you must count all employees, both US and non-US based and meet the 500 or less employee count threshold to be eligible. Also, you must use the funds for US based employees in both scenarios.

- Upcoming Webinars and Helpful Resources

- Stambaugh Ness Town Hall (Tuesdays 2-4pm)

- Trout CPA: Understanding the NEW PPP Loan Forgiveness Application webinar (Wednesday, May 20th at 10 AM).

- NFIB: PPP Loan Forgiveness Explained and Other Questions Answered (5/20 @ 12pm).

- EisnerAmper – Insurance Recovery for Pandemic Losses: Issues and Options (5/20 @ 2:15pm)

- RKL Weekly Webinar Series (Fridays)

May 19, 2020 – MPL General Counsel Corner – PPP Round 2 Funds Availability Increasing, not Decreasing

The Department of Treasury released stats yesterday for the PPP through 5/16/2020. Interestingly, they pooled everything together (i.e., round 1 and round 2) for this update. If my math is right (see attached spreadsheet), total funds allocated for round 2 declined to $171B from $189B as of the last update from 5/8 The average loan size per borrower also continued to drop to ~$64k per recipient from ~$74k as of 5/8 and $206k for Round 1.

Even with the good faith certification uncertainty removed, it looks like more borrowers are opting to return the PPP funds. Possible reasons for the increasing availability of round 2 PPP funds could be a slower than expected business reopening environment if at all (i.e., no sense in taking the loan if the forgiveness benefit cannot be realized) or no real need for the funds. The optimist in me hopes it is the latter, but the realist tells me it is likely the former. If you have returned the PPP funds, please make sure you are fully reviewing the other relief options that are available such as employee retention tax credit.

Also, for those that are approaching the end of your PPP initial 8 weeks, here is the loan forgiveness application. There are several PPP Loan Forgiveness webinars that are coming up. I have listed them in the bullet points below.

Here are some other things that may be important or relevant for you:

- Upcoming Webinars and Helpful Resources

- Trout CPA: Understanding the NEW PPP Loan Forgiveness Application webinar (5/20 @ 10 AM).

- NFIB: PPP Loan Forgiveness Explained and Other Questions Answered (5/20 @ 12pm).

- EisnerAmper – Insurance Recovery for Pandemic Losses: Issues and Options (5/20 @ 2:15pm)

May 20, 2020 – MPL General Counsel Corner – Happy House Hunting in PA this Weekend

In PA, the real estate market may get moving again. Governor Wolf issued updated guidelines for realtors beginning this Friday. Just so everyone knows, PA is the only State, until Friday, to not allow the real estate business to function. I am sure there are legitimate reasons for this restriction, but it sure seems strange that PA is the only State to impose it. Outside of that, it looks like the housing market has been surprisingly resilient in other areas of the country, according to a recent article in Money.com. Home renovation spending seems to be benefitting as well.

Happy house hunting in PA this weekend if you are in the market.

Here are some other things that may be important or relevant for you:

- Restaurants Not Benefitting from PPP – Check out the latest update from Joel Berg at biznewsPA. He provides some excellent data points about the Restaurant market.

- Updated PPP FAQ #48 – The SBA extended the deadline for lenders to submit form 1502 to May 29 from May 22. Form 1502 is the information reporting form that lists payment and loan information.

- Upcoming Webinars and Helpful Resources

- EisnerAmper – Insurance Recovery for Pandemic Losses: Issues and Options (5/20 @ 2:15pm)

May 21, 2020 – MPL General Counsel Corner – What does re-opening look like?

What does re-opening look like and how does that impact your business. I have come across a few helpful resources and articles that may be helpful for you.

- 5 Tips for Safely Reopening Your Office

- CDC Releases Comprehensive Coronavirus Guidance

- Fear of Returning to Work: When You’re Ready but Your Employees Are Not

Regardless of what you decide, please make sure you understand the local reopening plan for your business. Also, discuss how your business will fit in this plan with your leadership teams, mentors, board of directors and/or professional advisors. It could save you a lot of headaches once things get back to normal.

Here are some other things that may be important or relevant for you:

- LAW 360 State by State Coronavirus Regulations – This is a great overview of the various Covid-19 related regulations implemented by each State updated as of 5/20.

- Interim Final Rule – Second Extension of Limited Safe Harbor with Respect to Certification Concerning Need for PPP Loan and Lender Reporting – Essentially, the Safe Harbor provision was modified again for lenders. They now have until 5/29 or 10 days after loan disbursement to report borrower information to the SBA.

- Upcoming Webinars and Helpful Resources

- Trout PPP Forgiveness Webinar Links:

- NFIB PPP Loan Forgiveness Webinar Links:

May 22, 2020 – MPL General Counsel Corner – PPP Loan Forgiveness – A Tale of Two Cities

The million-dollar question (bad analogy, but the best I can come up with): What does the loan forgiveness process look like? I have chatted with several lenders and the most common response has been: “we are working on it”.

Here is what I know:

- The Lenders have 60 days from the submission of the forgiveness application to provide an answer to the borrower.

- The Lenders will be making an initial determination, which will then be submitted to the SBA for ultimate approval and funding (also falls in the 60 day timeline).

- Paperwork submission and review will not be uniform in terms of the way you send it to the Lender.

- One lender email that I recently reviewed mentioned a link to a portal will be used for document submission.

- Another lender is not certain if they will use internal staff or outsource the document review to a third-party consultant. They have also not decided how the document submission will work.

- I have included a few useful links for PPP forgiveness guidance from the US Chamber of Commerce, Trout CPA and RKL.

- US Chamber of Commerce: PPP Guide to Loan Forgiveness

- Trout: Loan Forgiveness Worksheet

- RKL: PPP Forgiveness & Cashflow Link

The long and short is that this process will likely not be uniform at the start, but hopefully will improve over time. It will also be a “Tale of Two Cities” as the larger (>$2M) PPP loans will be scrutinized and questioned more versus the smaller (<$2M) PPP loans.

I hope you get out and enjoy your Memorial Day this weekend.

Here are some other things that may be important or relevant for you:

- Upcoming Webinars and Helpful Resources

- KMRD Partners’ Return to Work Action Webinar (5/27 @ 10am)

- RKL: PPP Forgiveness & Cashflow Link

- Trout PPP Forgiveness Webinar Links:

- NFIB PPP Loan Forgiveness Webinar Links:

May 27, 2020 – MPL General Counsel Corner – Things Must Be Moving To “Normal”

I am noticing that updates and questions about relief programs are slowing down. It seems that businesses and organizations are getting laser focused on re-opening and what that means. Moreover, if you look at the most recent PPP lending numbers through 5/23/2020, there is still funding left. The average loan size in round two declined from to $61k per borrower as of 5/23 from $64k as of 5/16. Also, the total amount of approved loans continued to shrink from $171B as of 5/16 to $169B on 5/23. See my attached spreadsheet for the updated loan numbers.

The optimist in me says that things are settling down and must be moving to “Normal”. Let’s hope the second half of 2020 is better than the first half. Regardless, you choose whether you want to participate in a recession.

Here are some other things that may be important or relevant for you:

- Law360 Regulatory Update: Here is the latest Coronavirus regulatory updates on a State by State basis.

- NFIB – Pennsylvania Call w/ Congressman Perry – I listened to a conference call with Congressman Perry from PA yesterday. The one key point is that any stimulus package that comes next must include some form of liability protection for business and organizations from Coronavirus related lawsuits to have any chance of passage.

- PPP Accounting Articles – Check out these latest updates

- Accounting for PPP Loans – A helpful article on the Accounting treatment of PPP loans (sent by Trout CPA)

- PPP Forgiveness Guidance Issued as Congress Mulls Changes – Journal of Accountancy (sent by Carey Gertler @ EisnerAmper)

- PA 30 Day Fund – a new funding option created to help PA small businesses (3-30 perople) launched by Jeff Bartos, Richard Phillips and Roger Braunfeld.

- Coronavirus Bankruptcy Tracker – An unfortunate situation, but a reality given the times. Check out the list compiled by Forbes.com.

- Upcoming Webinars and Helpful Resources

- KMRD Partners’ Return to Work Action Webinar (5/27 @ 10am; thanks to Doug Berman from RKL for bringing it to our attention)

- NFIB PPP Loan Forgiveness Webinar (5/27 @ 12pm)

- Inc.com Real Talk Business Reboot – Standing Out and Communicating in Unexpected Ways Webinar (5/27 @ 1pm)

- RKL: PPP Forgiveness & Cashflow Link

- RKL: PPP Loan Forgiveness Webinar (5/23)

- Pitchbook Private Debt Market Webinar (6/9 @ 1pm EST)

May 28, 2020 – MPL General Counsel Corner – Just the facts, Ma’am

Today’s update is short and sweet, which may be another sign of out move back to normal.

In the immortal words of Sergeant Friday, today’s update is “Just the facts, Ma’am”

Here are some other things that may be important or relevant for you:

- Daddy Where Do Dollars Come From – Check out the latest update from Brian Luster at Collective Family Office. It is an interesting and quick overview of the impact that the stimulus packages could have on our Economy.

- Greater Capitalism – How the Pandemic is Permanently Reshaping our Economic System for the Better – This is an interesting compilation of interviews with some influential business leaders published in Forbes.com earlier this week. It may be one to add to your weekend reading.

- PPP FAQ Update – The main update is a revision of Question 45. It updates the safe harbor deadline to May 18, 2020 from May 14, 2020. The funny thing is that it was published on May 27th.

- Upcoming Webinars and Helpful Resources

- Pitchbook Private Debt Market Webinar (6/9 @ 1pm EST)

May 29, 2020 – MPL General Counsel Corner – PPP Recipients Get A Potential Lifeline

As many of you have heard, the House (not the Senate) passed legislation (H.R, 7010) that relaxed some key restrictions that were in place under the PPP. Below are the key components:

- The time to seek full forgiveness would be extended to 24 weeks from 8 weeks.

- The minimum amount of payroll that must be spent on payroll would be lowered to 60% from 75%.

- New applications for PPP funds would be extended from June 30, 2020 to December 31, 2020.

- The loan terms would be extended from two to five years.

- The deferral period for interest on the PPP loan increases to 10 from 6 months.

- PPP borrowers would also be eligible to participate in the payroll tax deferral program under the CARES Act (i.e., 50% of 2020 employer payroll taxes would be due in 2021 and the remaining 50% in 2022).

- The bill also provides more safe harbors for employers that cannot meet the FTE requirements.

The Senate has been working on a similar bill, but the restrictions are a bit narrower. Senator Rubio also expressed concerns that there are technical errors in the House bill. Specifically, he highlighted the following:

- The language around the 60% threshold is more restrictive because a business would have to use at least that amount to be eligible for any forgiveness (the current PPP rules have a sliding scale if you are below 75%).

- There is also language that changes the requirements for rehiring employees, which Senator Rubio asserts would eliminate the employee retention mandate.

Regardless, it appears that PPP recipients will get a potential lifeline in the coming days.

Here are some other things that may be important or relevant for you:

- Litigation Update – Law360 puts out a weekly overview of the various coronavirus litigation actions. These will surely be an ever present part of our system for many years to come.

- PA State Legislature Approves $225M for Small-Biz Relief – Check out the latest update from Joel Berg @ biznewsPA.

- PA Businesses are joining the call for Coronavirus Liability Protection – The PA Chamber is joining healthcare industry groups in pushing for civil immunity related to the Covd-19 Pandemic. This mirrors what we are hearing from the Republicans on the national level.

- Upcoming Webinars and Helpful Resources

MPL General Counsel Corner – Time to shift a bit – Focus more on Reopening & Recovering

Businesses around the country are starting to reopen and some are doing it in defiance of Governor’s mandates. A salon owner in TX was jailed (and ultimately released) for violating a lock down order, while two PA based businesses (another salon and a gym) are back to serving customers in open defiance of the Governor’s shutdown. The US Supreme Court also denied an emergency petition to reopen businesses in PA on Wednesday.

The momentum to open versus lock down is certainly accelerating. As a result, I want to shift a bit to share more updates on topics around reopening and recovering. Hopefully, these additions to our updates will spur some additional thought for you.

Here are some other things that may be important or relevant for you:

- Perhaps Business Owners Should Think About Some Estate Planning – Brian Luster from Collective Family Office provides a great overview of some Estate Planning topics to think about in the current low interest rate environment.

- New Guidance on Worksharing from the Department of Labor – Tedd Kochman from Littler provides a good recap and updated DOL guidance around the Short Time Compensation (i.e., worksharing) provisions of the CARES Act. It may be a good way to bridge the gap from lay off to full time employment.

- Updated PPP FAQ (Questions 45): Essentially, this clarification says that if a business returns the PPP loan in full by 5/14/2020, then they are eligible for the Employer Retention Tax Credit.

- Economic Indicators and Market Stats: Larry Moskowitz, Certified Financial Services, shared the weekly economic indicator update from JP Morgan Asset Management. FYI, the NASDAQ is close to being positive for the year.

- Upcoming Webinars and Helpful Resources

- Reopening PA – I sent out a link yesterday which did not work. It is the PA Chamber’s bringingpaback.com website to help PA business reopen. It lists all the reopening initiatives by county as well as policy support statements and resources.

Please see all of our prior updates at the this link or if you would like to be added to our email list, please click here.

As always, please don’t hesitate to email myself (jsanders@mpl-law.com), Andy Miller (amiller@mpl-law.com), Christian Miller (cmiller@mpl-law.com) or anyone in our office with questions or comments.

April 2020 – Covid-19 Legal Update Archive

- April 1, 2020: PPP Guidance, SBA Updates & Some Humor

- April 2, 2020: COVID-19 Loan Program Updates

- April 2, 2020: Interim Final Rule for PPP issued

- April 3, 2020: PPP Application Submissions….its kind of like Black Friday Shopping…but this is actually serious!

- April 5, 2020: Covid-19 Disaster Funding Programs – If you stare long enough, you will see a sailboat

- April 6, 2020: More PPP info (or confusion) & Lunchspirations Podcast Registration

- April 7, 2020: When will this be over? PPP FAQ

- April 8, 2020: COVID Business Law Update: If you are going through hell, keep going

- April 9, 2020: Christian Miller’s COVID-19 Legal Updates for April 9th

- April 9, 2020: Schools out, at least for this year – Keep Moving Forward

- April 10, 2020: Top Ten EIDL and PPP Questions

- April 13, 2020: MPL General Counsel Corner – Another day closer

- April 15, 2020: MPL General Counsel Corner – Let’s Hope These Aren’t Meetings About Meeting

- April 16, 2020: Attorney Christian Miller: COVID-19 Update

- April 16, 2020: MPL General Counsel Corner – Going, Going….Gone (Maybe?)

- April 17, 2020: No more PPP, No More EIDL, Now What?

- April 19, 2020: You Don’t Have to Participate in A Downturn

- April 20, 2020: Race to open….kind of

- April 21, 2020: MPL General Counsel Corner – Why are we waiting?

- April 22, 2020: Crickets from DC, but Fireworks Likely in Harrisburg

- April 23, 2020: No word yet from DC

- April 24, 2020: General Counsel Corner – PPP: Think Before You Apply

- April 26, 2020: MPL General Counsel Corner – An Attorney That Represents Himself Has A Fool for A Client

- April 27, 2020: MPL General Counsel Corner – And They Are Off And Running

- April 28, 2020: MPL General Counsel Corner – I’m from the government and I’m here to help…unless you don’t need the money

- April 29, 2020: MPL General Counsel Corner – Another day, a few more updates

- April 30, 2020: MPL General Counsel Corner ….and now on the first tee

April 1, 2020: PPP Guidance, SBA Updates & Some Humor

Given its April Fool’s Day, I was going to have the following headline: “Coronavirus defeated, all social distancing rules lifted.” However, in the current environment, I will reserve my humor for other topics (see the end of the email).

It is definitely a weird time. I was chatting with a friend/business coach/Vistage Chair (Chad Harvey; www.chadharvey.com) yesterday. He said it best: “Every day, I feel like I have worked harder than I have before only to complete at best half of what I planned to do”……Wise words that sum up my daily work routine as well.

Here are the things that I think are important and you may want to review:

- PPP guidance provided, sample application linked here. The much-anticipated guidance on PPP was released by the SBA and the Department of Treasury. Loans can start to be processed in April. As a reminder, this guidance and the program are being updated almost daily. Please make sure you review your options with your Bank. The King of Prussia SBA Office provided the following guidance last night:

“SBA will be providing more guidance to lenders shortly which will be provided through their respective banking and trade associations. This will happen in the next 24 hours. So what can you do?

- Familiarize yourself with the (current version) of the PPP application – linked above

- Start to gather any information you have which may justify their payroll/loan amount calculation (official guidance is forthcoming).

- Once we receive word from the SBA on any other required documentation, we will let you know.”

- Linked is a list of SBA lenders and consultants (not exhaustive, but a good start….if you are not on the list, please send me your details)

- SBA and other COVID-19 Disaster Loans; Things You Should Consider If You Have Preexisting Loans: As you are applying for the various programs, please make sure you are reviewing any of your preexisting loan documents and talking with your legal counsel, accountant, banker or other professional service provider. Also, the linked document provides a good comparison of PPP and EIDL. Below are some questions to consider:

- What are the recourse provisions (e.g., personal guarantees)?

- What impact will the new SBA loan have on existing collateral?

- Are there any cross default issues?

- Are there any non-monetary default provisions?

- What happens if you file for bankruptcy or close the business?

- Will the bank take a second position to the new SBA loan?

PLEASE LET US KNOW IF YOU WOULD LIKE TO DISCUSS ANY OF THE TOPICS ABOVE

- PA Working Capital Assistance Program has been exhausted; Nothing definitive as a follow on, but more could be proposed.

- Upcoming Webinars

- RKL Webinar 4/3/2020 @ 11am

- EisnerAmper 4/2/2020 1:30pm-3pm

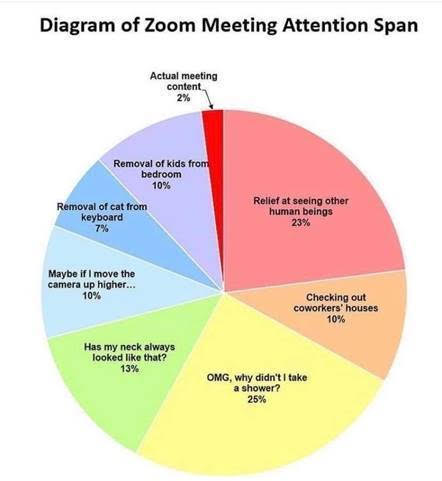

And last but not least, we did an informal survey of ZOOM users and their meeting usage time. Below are the results of the survey:

April 2, 2020: COVID-19 Loan Program Updates

Lenders are preparing documents and moving as fast as they can to start processing the PPP loans. Borrowers are trying to figure out what the best loan package would be for their respective businesses. I think I can safely say that It’s a Mad, Mad, Mad, Mad Covid-19 Rescue Loan World (if you haven’t seen the movie, add it to your list of things to watch….it can’t be that long by now).

Here are some things that we think may be important to know.

- SBA Lenders Approach to PPP Processing Varies: We have been hearing from many lenders that they will only work with their existing customers first. It is understandable. One lender noted that last year they processed 1500 SBA applications in total. With the PPP, they are expecting 40,000 applications. Talk about overload. In case you did not have a lender identified, please see the linked list for contact information. We are also linking a helpful worksheet which may help you determine your payroll for the PPP amount. Lastly, if your current lender or bank is SBA approved, then I would suggest approaching them first.

- One of many unintended consequences: An article was forwarded to me that discussed the unintended consequences of the various loan programs for the restaurant business. If you have a few minutes, I would suggest reading it. The link to the article is here.

- Requests for PA Waivers for non-life-sustaining business will close tomorrow at 5pm. The link to submit a waiver is available here.

- Upcoming Webinars:

April 2, 2020: Interim Final Rule for PPP issued

In trying to keep you as up to date as possible, linked is the Interim Final Rule for the Payroll Protection Program (PPP). For those that don’t know what an interim final rule means, it is essentially the final rule with a timeframe to make additional comments and clarifications. It is used when something is passed and implemented quickly.

Below are the high-level bullet points that I thought were new or provided more clarification. The big one is the interest rate is 1%, not 0.5%.

- Lenders are not required to comply with the SBA’s lending criteria. They can rely on certifications of the borrower to determine eligibility and use of the proceeds.

- Lenders will be held harmless for borrowers’ failure to comply with program criteria

- If you do not have traditional payroll documentation, you can provide other forms such as bank records that can show your payroll.

- You are ineligible if you are a household employer (i.e., you have a nanny or housekeeper)

- The applicable interest rate is 1% and the term is two years. This is different from the prior guidance of 0.5% and 2 years.

- E-consents/E-signatures are permitted.

- PPP is first come, first served.

- PPP loan payments are deferred for 6 months, but interest will accrue during the deferral period.

- Independent contractors do not count as employees for PPP loan forgiveness

- Applicants must submit Form 2483 and payroll documentation. Lenders must submit Form 2484 electronically.

- If you received an EIDL loan from 1/31/2020: 4/3/2020 and it was not used for payroll costs, then you are eligible for a PPP loan. If your EIDL loan was used for payroll costs, then the PPP loan must be used to refinance your EIDL loan.

- If you received any advance (up to $10,000) on the EIDL, it will be deducted from your loan forgiveness amount on the PPP loan.

- Agent Fees (i.e. consultants) will be paid by the lender from the fees they receive from the SBA. Fees may not be collected from the borrower or out of the PPP loan proceeds.

I am sure there are still lots of questions. Let us know if we can help answer any of them (to the best of our ability).

April 3, 2020: PPP Application Submissions….its kind of like Black Friday Shopping…but this is actually serious!

I hope all of you who are eligible got your paperwork in for the Paycheck Protection Program. Like any mad rush, the system got overwhelmed and we are hearing that processing has been delayed. It’s kind of like Black Friday Shopping: A lot of craziness for lots of deals….but this is actually serious!. Let’s hope the processing issues get resolved and the funds get to as many businesses as possible.

A few things:

- PPP Application: Please make sure you are using the latest PPP application. Linked is a copy. If you have not submitted the paperwork as of yet, we have a list of SBA lenders linked. We have also created a memo which outlines the Interim Final Rule (i.e. guidelines) for the loan along with some other useful PPP docs. Also, the PPP worksheet that we sent around yesterday was meant purely as a helpful tool. It was shared with us by a local lender. It may not be up to date with the latest guidance from the SBA.

- NJ Economic Relief Program for Businesses: Apologies for not sending this out earlier. Here are the links for the NJ relief for small businesses. The application period is open until April 10th.

- 10 Point Plan for Restaurant Employers: The following article has a good 10 point plan for restaurant employers. It may be of use if you are in the restaurant or hospitality business. The link is here

- Market goes up more than down over time: Check out the linked chart from Jackson National Life Insurance Company. It highlights the various crisis events and the subsequent market returns. Pretty interesting. Thanks for forwarding to me Larry Moskowitz.

- Retirement Accounts present another funding option from the CARES Act (WE ARE NOT OFFERING AN OPINION ON THIS….MERELY PROVIDING THE INFO…TALK TO YOUR PLAN ADMINISTRATOR OR FINANCIAL ADVISOR FOR MORE DETAILS)- The CARES Act allows eligible participants to request penalty free distributions of up to the lesser of $100,000 and qualified loans of up to $100,000 or 100% of a participants vested balance for qualifying corona-virus related reasons. The reasons could be:

-

- You have been diagnosed with COVID-19

- You have been significantly impacted financially (i.e., furloughed, laid off, work hour reduction, business closure, etc.) due to COVID-19.

- Upcoming Webinars:

-

- Attract Capital (Dave Barnitt, dbarnitt@attractcapital.com): See the linked announcement for a Coffee Chat scheduled for next Tuesday April 7th, 10am.

-

-

- Huntington Bank, COVID-19 SMAR Talk Weekly Webinar, Wednesday April 8, 2020, 1pm-2pm: The registration link is here.

-

Please see all of our updates at the following link: https://mpl-law.com/resource-center/

As always, please don’t hesitate to email myself, Andy Miller (amiller@mpl-law.com) or Christian Miller (cmiller@mpl-law.com) or anyone in our office with any questions or comments.

April 5, 2020: Covid-19 Disaster Funding Programs – If you stare long enough, you will see a sailboat

More clarification about the various SBA programs came out late Friday. These rules are getting a little clearer as time goes by. Please use common sense and rely on your professional advisors when considering your options. However, I can’t help but feeling like the guidance around the programs is a lot like the magic eye scene in Mallrats. If you stare long enough at the various Covid-19 disaster funding programs, you will see a sailboat (or at least find something that fits your situation).

Here are some things that we found relevant:

- Affiliated Business Guidance for PPP Loans: Essentially, if a business operates with a number of separate affiliates, they are all rolled up into one entity for PPP eligibility purposes. However, there are waivers for hospitality businesses and faith-based organizations. Please review the linked documents (Affiliation rules overview, DOT Affiliation Interim Rule, SBA Faith Based FAQ) for further clarifications.

- PPP Successes: I have confirmation of two companies locally that received preliminary approval for the PPP loan. While I have heard of more issues that the processing system is overloaded, it should continue to improve and more will be approved. See the linked list for SBA lenders and consultants if you have not applied yet.

- TSA #s show the dramatic drop in travel: Check out the travel numbers on the TSA Site. From March 16th to present, flying has come to an almost stand still. It would be nice to see the recovery of these numbers snap back as quickly as they fell. Time will tell.

- Planning and managing layoffs/furloughs: While I hope these are kept at a minimum, it is an unfortunate reality that layoffs and furloughs are going to occur because of the current situation. The article, written by David Ulevitch (a general partner from Andreesen Horowitz), at the following link provides some useful things to think through before and during implementation. Here is the article link.

- Upcoming Webinars:

- The Council for Insurance Agents and Brokers; PPP Program Overview; April 6th @ 1130 (From Jeff Kile @ the Glatfelter Agency): The registration link is listed here.

- Attract Capital (Dave Barnitt, dbarnitt@attractcapital.com): See the linked announcement for a Coffee Chat scheduled for next Tuesday April 7th, 10am.

- Huntington Bank, COVID-19 SMAR Talk Weekly Webinar, Wednesday April 8, 2020, 1pm-2pm: The registration link is here.

April 6, 2020: More PPP info (or confusion) & Lunchspirations Podcast Registration

More PPP info (or confusion) & Lunchspirations Podcast Registration

We have the start of another week and the data keeps coming.

Coming up on Wednesday 4/8/2020 from 12-1pm, James Sanders will be doing a live online interview for Lunchspirations (hosted by Karl Diffenderfer) to talk about business disaster recovery programs and other issues surrounding businesses in this environment. If you would like to register to attend, the link is available here.

Other than that, here is some information that we think is of value for you:

- PPP – More confirmations have come through of loan pre-approvals. Check out the latest from the Hustle — the two items below are pretty informative:

- Hustle Small Business Resource Guide

- Reddit Guide for Small Businesses (from the list of links in the Hustle Small Business Resource Guide): the stories shared on here provide some good anecdotal evidence of business owners experiences applying for the different disaster recovery programs.

- Wells Fargo puts a cap on their PPP loan participation. Check out the story here. If you have not applied as of yet, I would recommend you reach out to your lender or one of the contacts on the linked list. FYI, the list below is documents one lender is requiring to put the loan application into the system.

-

- Most recent business tax return

- 2019 Total Gross Sales/Revenue (we just need the dollar amount)

- Year Business was Established

- Driver’s License (FRONT AND BACK) for all owners > 20%

- 940 AND 941 reports (12/31 and 3/31/20)

- Payroll report from 2/15/20 (or closest date)

- Annual payroll report for 2019 year end

- Did you apply for the $10K Advance from EIDL (if yes, have you received the $10K?)

- PPP Questions I am hearing most often today:

- Is there a size limitation for a small business other than <500 employees?

- According to the interim final rule, a small business is “ defined in section 3 of the Small Business Act (15 USC 632), and subject to SBA’s affiliation rules under 13 CFR 121.301(f) unless specifically waived in the Act.” So, what does that mean. Well, the SBA has a good link to help you determine if you are a small business. The link is here. If you have any questions, please let me know.

- What happens if I apply for the PPP loan, bring back all of my workforce and then have to subsequently let people go because of the current situation during the first eight weeks?

- Essentially, you would have a low interest loan for any amount that does not qualify for forgiveness that could be paid back at any time.

- Is there a size limitation for a small business other than <500 employees?

- Upcoming Webinars

- NFIB & VP Pence provide a Coronavirus Update (4/7/2020 from 11am-12pm): The live streaming link is available here.

- Attract Capital (Dave Barnitt, dbarnitt@attractcapital.com): See the linked announcement for a Coffee Chat scheduled for next Tuesday April 7th, 10am.

- Huntington Bank, COVID-19 SMAR Talk Weekly Webinar, Wednesday April 8, 2020, 1pm-2pm: The registration link is here.

-

April 7, 2020: When will this be over? PPP FAQ

When will this be over? I wish I had an answer, but what I can tell you is that I am hearing more and more from very influential people is that this has to stop. By “this,” they are referring to the economic shutdown. Right, wrong, or indifferent, when I keep hearing the same thing over and over, I know that we are closer to the end of this than not.

Here are some articles that tell me this is the case or at least show a path out.

- “No one wants to talk about this”: CEOs debate the coronavirus shutdown

- A bill that was just introduced by PA lawmakers would seek to secure “waiver[s] to the Governor’s 20200319 TWW COVID 19 Business Closure Order to all public and private construction activities that can adhere to social distancing practices and other mitigation measures defined by the Centers for Disease Control to protect workers and mitigate the spread of the COVID-19 virus.” A link to the bill is here.

- See the linked economic data and market performance from Rob Teeter at Silvercrest Asset Management Group (thanks to Sean O’Dowd for sending to me).

Other than that, I do remain optimistic because private business is helping us to get through this situation and will be the engine which drives the recovery.

Here are some other things that are important:

- PPP FAQ sheet: Rather than reinvent the wheel, I am including the important points which were provided by Chad Bumbaugh at Stambaugh Ness. If you have not applied, please reach out to your bank or anyone on the list.

- Questions 2 & 3 hit on general eligibility.

o Eligible if under 500 employees, or under “small business concerns” standards by NAICS code which we knew

o Added eligibility if meeting “small business concern test” (max net worth not > $15mm, average net income for last two years not more than $5mm)

o Clarified that businesses don’t have to meet all other definitions in Section 3 of SBA.

- Questions 4 – 6 hit on affiliation rules

o Lenders aren’t required to certify, clarified these rules must be applied.

- QUESTION 7 – Clarification of $100k compensation cap

o The $100k Cap applies to only cash compensation – not non-cash benefits like employer contributions to retirement, healthcare, taxes

- QUESTION 14 – Clarification of time periods for calculating payroll costs & number of employees

o Calendar 2019 or preceding 12 months both acceptable

o Average employment or per pay average for determination of number of employees

- Question 15 – Again emphasizes that payments to independent contractors are not in the borrowing base

- QUESTION 16 – Clarification on impact of fed taxes in relation to payroll costs – fed wages withheld do not reduce the wages for purposes of determining the PPP loan amount.

- Upcoming Webinars

Please see all of our updates at the following link: https://mpl-law.com/resource-center/

As always, please don’t hesitate to email myself, Andy Miller (amiller@mpl-law.com) or Christian Miller (cmiller@mpl-law.com) or anyone in our office with any questions or comments.

April 8, 2020: COVID Business Law Update: If you are going through hell, keep going

I am not sure if you have been following the estimates of Covid-19, but I wanted to look at how they have changed over the last several weeks. Check out the numbers and reference links below.

- 3/13/2020 (200,000-1,700,000 estimated Covid-19 deaths in the US per the CDC): The link to the story is here.

- 3/30/2020 (100,000-200,000 estimated Covid-19 deaths in the US per Dr. Fauci): The link to the story is here.

- 4/8/2020: (60,415 estimated Covid-19 deaths in the US per Healthdata.org): The link to the data is here.

While there are a few different sources, the reported estimates continue to fall (thankfully) versus climb. It tells me that we are getting closer to the end of this situation.

- What are you doing to ready yourself and your business for the other side of this situation?

- Have you reviewed your loan documents, applied for emergency assistance, updated your operating documents, checked on insurance coverages, and so on.

- Follow the flow of a dollar from entry into your business all the way to the exit to look for ways to enhance or improve the process.

- Now is the time to have conversations about your business and what it will look like going forward with your trusted group of advisors.

As Winston Churchill said: “If you are going through hell, keep going”

We will get through this situation and you and your businesses will be the engines of recovery.

A few things I felt may be of importance today:

- Disaster Loan Program or Payroll Tax Credit, which is right for my business? Take a look at this article. I think it gives a good overview of the puts and takes of each. Contact your bank or any of the contacts on the linked list if you pursue the disaster loan process.

- SCORE Covid-19 Resource Center: If you are looking for a business mentor or other information from SCORE related to Covid-19 Resources, check out this link.

- Upcoming Webinars:

- NFIB Coronavirus Part V; Friday April 10, 2020; 12-1pm: Register for the event here.

April 9, 2020: Christian Miller’s COVID-19 Legal Updates for April 9th

It has been some time since I sent out an update, as things have been hectic dealing with the new loan programs and assisting many of you with the PPP Loan Application. However, I wanted to get some new information out regarding some updates and additional information on the COVID-19 programs aimed to assist small businesses.

Linked is a memo that provides clarification from the Dept. of Labor regarding implementation of the two paid leave programs (or expansions in the case of FMLA) for employees effected by COVID-19. These were released on April 1st, so if you have already seen them this might be a duplication of information. To provide you with additional context, I am also linking prior memos (1), (2) regarding paid leave programs to fill in any gaps in your recollection of these programs (they have older dates – disregard if a recap isn’t helpful). An important reminder I have been asked about is the interplay between the paid leave benefits and the increased unemployment compensation benefits. Please know that these can’t both exist, as the paid leave programs were one attempt to keep employees on payrolls and off UC benefits. So if employees were laid off (and applied for UC), you do not have to worry about the paid leave programs (the payments or the credits) unless an employee is subsequently rehired.

I am also linking an updated FAQ sheet related to the PPP Loan Program. One of the interesting updates (via an added question) is that funds must be disbursed within 10 days of loan approval. Many of you have received PPP approvals, but have not seen any documentation or disbursements, so it will be interesting to see this point in practice. We welcome any questions about the PPP Loan Program, but we also advise discussing with your lender (although you have to understand they are highly burdened right now) as they are the ones charged with administration of the PPP Loan Program, and will be in the best position to advise. Some additional advice on PPP questions is not to plan on how to use the funds until you have the approval and the loan documents/information from your lender. Things remain very dynamic, so it would be best practice to reserve any analysis until you have the loan documents and information (from your lender) in hand to know the exact parameters of the loan. Then is the time to review, ask questions, and develop a plan to best maximize the funds and the forgiveness element. Doing so beforehand requires speculation, and may end up being scrapped in the end. Our office is more than happy and equipped to assist with the review and implementation of the program from a practical ase

Finally, I encourage all of you to take a peek at the information, resources, and contacts on our MPL Law Firm Resource Page. Although it has been a few days since I pushed out an update, this site is frequently updated with new information. For tax information related to the COVID-19 assistance, and more importantly the CARES Act, feel free to review information here from Eisenhart & Co., one of our trusted CPA partners. Thank you, and stay safe.

April 9, 2020: Schools out, at least for this year – Keep Moving Forward

It looks like PA has followed a lot of other States. We were just informed this morning that the PA Dept. of Education has decided to close schools for the remainder of the school year. Thankfully, our school district launched their “Forward Learning” initiative so our kids could continue with instruction online. As a friend/colleague said to me earlier today, “the enjoyment of having lots of family time is wearing off and the kids are missing their friends.” I know some of you can relate.

That being said, the current normal is a place where our personal and business lives continue to collide. I cannot emphasize it enough, it is more important than ever to be working on your business and looking for ways to survive through the current times and thrive when we get through it.

Below are a few articles that may help you navigate the current situation:

- Inc.com:

- Harvard Business Review:

KEEP MOVING FORWARD, IT WILL GET BETTER

A few other things that you should also look at as well:

- Dept. of Labor Guidance for Small Business Exemptions. Please take a look at our linked memo which highlights the new guidance which was issued by the Department of Labor related to exemptions and details of the Family and Medical Leave Ac and the Emergency Paid Sick Leave Act.

- PPP Program Updates: A few things on this

- Additional FAQs were issued last night (see linked document) The two big additions were: 1. SBA lenders could use their own promissory note documents to close PPP loans; and 2. SBA lenders must distribute the funds approved by the SBA within 10 days of commitment. This could cause some business owners to think a little more creatively about when or if they are applying and signing for the PPP loan.

- Tomorrow, the PPP applications for independent contractors and self-employed individuals can be processed. Please reach out to your bank or any other SBA approved lending institution if you need help. Linked is a list of SBA approved lenders and consultants that we have worked with in the past.

- Monkey See, Monkey Do: A bill was introduced in the PA House to force COVID-19 business interruption coverage. This follows similar bills in LA, NY, OH, MA and NJ. The article is here.

- Helpful Resources & Upcoming Webinars

- Karl Diffenderfer, CEO and Founder of Higher Impact Business and Life Coaching, is offering (gratis) his time and advice to business owners during this situation. Please contact him directly (karl@higherimpact.me; 717-201-8536)

- Hitesh Patel, Transworld Business Advisors, sent over the following helpful podcast for entrepreneurs: The Deal Board. He is offering Broker Opinions of Value for owners thinking of selling or planning ahead for an eventual exit strategy. Please reach out to him directly (hpatel@transworldpa.com)

- Town Hall Meetings for CEOs and Owners (4/14 @ 7am): Mark Sussman (mark@strategicbizgroup.com) of the Strategic Business Group will be hosting a virtual townhall for CEOs and Owners. Click here to register to attend.

- RKL Weekly Coronavirus Webinar (4/10 @ 11am)

- NFIB Coronavirus Part V; Friday April 10, 2020; 12-1pm: Register for the event here.

April 10, 2020: Top Ten EIDL and PPP Questions

NFIB Top Ten List

#10 – EIDL or PPP, which do you recommend, or should I do both?

The short answer is you can apply for both, but you cannot use the money for the same purposes; I also learned that EIDLs would be capped at $15k per application if you have not received approval yet. It looks like $2,000,000 is not an option right now for the EIDL. PPP is the only program where applicants are receiving approvals and funds from what we have heard recently. Also, if you are in the Ag business, you are eligible for the PPP loan program, but are not eligible for the EIDL

#9 – Speaking of EIDL, what’s up with the $10,000 grant? I thought it was coming in 3 days.

There is no word on when these grants will be funded. However, we learned that these grants will be limited to $1,000 per employee up to the $10,000 maximum.

#8 – I’m going to apply for a PPP loan. How do I calculate payroll costs for employees who make more than $100,000?

You are capped at $100,000. Anything above that is not counted.

#7 – Could they make this any more confusing? My head is spinning. Once again, can you explain the formula for PPPL forgiveness?