It Ain’t Over ‘til It’s Over – Closing Time!

The big day is coming. You have crossed all the T’s and dotted all the I’s, or have you? There are a few crucial, yet often ignored items that you and your M&A team should make sure is finalized prior to at closing.

- Closing Process – How will closing be handled? Will it be in person or virtual? Who is holding any escrowed funds? How will the money be transferred?

- Settlement Statement/Flow of Funds – Just like buying/selling a house, the same holds true for a business. I highly recommend that you have a settlement statement prepared which details the sources and uses of funds.

- Closing Documents – Unless you are doing a “sign and close”, you should already have an executed purchase agreement. In that purchase agreement, there are likely schedules which should be finalized and exhibits that need executed. Examples of exhibits include a bill of sale, an assignment and assumption agreement, a seller creditor agreement, escrow agreement, and resolutions for the buyer and seller.

- Financing Documents – If the deal is being financed, have you gathered everything required by the financial partner. Has your team reviewed all the financing documents as well?

- Miscellaneous – Closing checklists, employment agreements, leases, bulk sale notices and so on are also other items that should also be a part of the preparation for closing.

- Closing Binder – Please make sure that you or someone on our team compiles a complete package (i.e., a closing binder) of everything that was reviewed during due diligence and executed for closing. If something comes up post-closing, this “closing binder” will be the focal point of any disagreements.

As Yogie Berra said – “It ain’t over ‘til it’s over.”

Here are some other items of interest:

- Choose High Conviction Acquisition Financing (attractcapital.com)

- The Advantage of a One-stop vs Two-stop Financing Deal (attractcapital.com)

- February Update from August Wealth Management (thanks to Howie Greenberg for sharing)

- EisnerAmper Webinar | Developments in Beneficial Ownership Information (BOI) Reporting Requirements (3/4 12pm-1pm; thanks to Cary Gertler for sharing)

As always, please don’t hesitate to email myself (jsanders@mpl-law.com), Andy Miller (amiller@mpl-law.com), Christian Miller (cmiller@mpl-law.com), Erik Spurlin (espurlin@mpl-law.com), Brad Leber (bleber@mpl-law.com) or anyone in our office with questions or comments. Please see all of our prior updates at this link or if you would like to be added to our email list, please click here.

Time to Put the Pen To Paper (or Just Type it Up)

As we have taken our M&A journey over the last few weeks, I hope that you have found the information provided useful. Thus far, you have figured out what you want to buy (or sell), found the right candidate, executed a letter of intent and done your due diligence. Now, it’s time to get serious and “put the pen to paper” (or for the rest of modern society, type it up).

Yes, I am talking about the purchase agreement. However, what goes into this document? First off, ask what you are buying (or selling). Is it just the assets or the whole company? Do you know the difference?

Asset Purchase Agreement – Simply put, the purchaser is only buying the assets of the company and the seller keeps everything else. This transaction is more common of the two main types of purchase agreements as it provides the most legacy liability protection for the purchaser.

Stock Purchase Agreement (fyi, for LLCs its called an Interest Purchase Agreement) – In this transaction, the purchaser is buying the whole company (both the assets and the liabilities). This type of purchase is done typically when the target company has unique characteristics or customers that could be lost if only the assets are purchased.

Once you decide what you are buying, you next decide on what goes into the agreement. Some of the key provisions include the following:

- Preamble, Recitals, Definitions – essentially who are the parties, what is being done and a definition of key terms;

- Purchase and Sale – description of what is being purchased, how it is transferred and what the allocation of the purchase price will be;

- Purchase Price Adjustments and Earn Outs – a description of adjustments to the purchase price at or after closing (e.g., if the inventory amount is different than the amount agreed upon); any earn outs that the Seller may have for future business; etc.

- Escrow – any amount of money held back by the Purchaser to ensure that the Seller follows through on post-closing conditions or to cover any post-closing issues (e.g., legacy tax liabilities) that may arise;

- Closing Mechanics and Conditions – When and where the closing occurs, what needs to happen to go to closing, what needs to be done after the closing;

- Representation and Warranties – statements of fact and assurances made between the purchaser and the Seller;

- Pre and Post Closing Covenants – any promises by one party to another related to the transactions (e.g., operating the business as normal, not working with any other counterparties, non-compete, non-solicit, non-disparagement)

- Termination – outline of ways that the agreement could be terminated and what the consequences of the termination would be;

- Indemnification – post-closing process to remedy any losses incurred by either party related to promises made in the purchase agreement

- Miscellaneous – this is where the lawyer language comes in; it contains many of the boilerplate clauses (e.g. assignment, notice, dispute resolution, choice of law, etc.); and

- Disclosure Schedules and Exhibits – this is the all-important section where the details of what is and is not being purchased are outlined; it is also where the peripheral documents (e.g., bill of sale, assignment agreement, escrow agreement, etc) are attached.

As always, I don’t recommend you drafting these documents on your own. Your business attorney, business accountant or any other key business advisors can be very useful resources to help you navigate this part of the M&A process.

Here are some other items of interest:

- House Legislation Urges Congress to Reduce Red Tape (nfib.com)

- Podcast: Experts Discuss Impacts of Beneficial Ownership Law (nfib.com)

- NFIB: Shapiro’s Budget Ignores the Fact PA is ‘Staring Down the Barrel’ of a Deficit – NFIB

- 2024 Outlook for Founder-Owned Business/Middle Market M&A – DAK (dakgroup.com) (thanks to Steve Raymond for sharing)

- EisnerAmper Webinar | Developments in Beneficial Ownership Information (BOI) Reporting Requirements (3/4 12pm-1pm; thanks to Cary Gertler for sharing)

- U.S. House Passes Bipartisan Tax Bill to Provide Business Tax Breaks, Extend Child Tax Credit Enhancements (troutcpa.com)

As always, please don’t hesitate to email myself (jsanders@mpl-law.com), Andy Miller (amiller@mpl-law.com), Christian Miller (cmiller@mpl-law.com), Erik Spurlin (espurlin@mpl-law.com), Brad Leber (bleber@mpl-law.com) or anyone in our office with questions or comments.

Please see all of our prior updates at this link or if you would like to be added to our email list, please click here.

A Comprehensive Guide to Commercial Title Insurance

What is commercial title insurance? Are there benefits to purchasing title insurance coverage for your commercial real estate property? If yes, what are they, and how can you get the ideal coverage?

Commercial title insurance offers protection to business owners acquiring real estate properties. In Pennsylvania, getting coverage is mandatory for properties secured by a mortgage but optional when you pay cash. Regardless of the situation, it’s wise to protect yourself and your business by considering the potential risks.

What Is Commercial Title Insurance?

Commercial title insurance is a unique coverage that protects the policyholder against financial losses resulting from issues with the property title. Purchasing a commercial property involves the transfer of title, which encompasses the owner’s rights and interests in the property. However, there are instances where a person’s property ownership may be challenged for one reason or another, even though they possess the deed.

Title insurance may reimburse you for your losses when another person establishes a claim against you regarding the property’s ownership. The payment may be partial or full, depending on the circumstances and terms of the policy. Again, title insurance mitigates the legal risks of acquiring a defective title. Before the insurance is issued, a thorough investigation is done to verify the property’s true owner. Flaws identified along the way may then be corrected if possible.

Here are two scenarios to help you understand the concept better:

- You search and find the perfect real estate property to start your business. You make the payment, sign the paperwork and move in, only to find out three months later that there is a lien on the property. You never knew about the lien, but a financial institution insists you have to pay an outrageous amount to prevent them from exercising their rights. The insurer may incur the covered expenses arising through the claim, regardless of its validity.

- You purchase a newly constructed commercial property but later learn that the seller had no right to sell the property. They knew the property was given to another person in a will, yet they went on to sell it as if it were theirs. In resolving any issue with the actual owner, the insurance company may cover your expenses and reimburse you fully or partially if you lose the property, depending on the extent of coverage.

What Are the Types of Commercial Title Insurance?

There are two types of commercial title insurance.

- Lender’s title insurance: This type protects lenders when legal issues arise regarding title to the property. It reassures the lender regarding the priority, validity and enforceability of its mortgage or lien. In Pennsylvania, title insurance is mandatory for real estate purchases secured by a mortgage.

- Owner’s title insurance: This type protects the property owner from claims against the title that predates their purchase of the property. It makes the insurance company financially and legally responsible for title issues that arise during or after the purchase, subject to the terms of the insurance contract. Title insurance is optional if you pay cash for the property, but it’s highly recommended.

What Does the Title Search Entail?

Title search is integral to the commercial title insurance process. It requires the insurance or settlement company to investigate the ownership of the property and resolve the defects. This review is thorough but necessary before you go to closing. Common title issues that may be uncovered include:

- Property disputes: There may be boundary disputes or issues with the interest in real estate being transferred. For example, the dimensions or location may differ from what was promised or the interest could be a life estate instead of a fee simple.

- Falsified documentation: People sometimes create false documents like a fake title chain. This fabrication conceals the rightful owner, making the sale challenging.

- Falsified identity: Like falsified documents, a person may also impersonate the property owner to deceive the buyer. A proper title search may reveal such discrepancies or offer a defense if the fact remains hidden after a diligent search.

- Estate problems: As earlier discussed, inheritance issues sometimes spring up in commercial property transactions. These issues can jeopardize the deal unless it is appropriately handled.

- Public record errors: Clerical or filing errors exist, which can affect the validity or accuracy of documents. It helps to work with an experienced professional with an eye for detail.

- Encumbrances: An encumbrance is a claim against a property from someone other than the property’s owner. Encumbrances can restrict your use of the property, which could potentially disrupt business operations. A title search can reveal these issues, helping you make informed decisions.

- Liens on the property: Liens enable creditors to assert rights over a property. Liens can arise in many ways, such as mortgage debts or unpaid construction services. Resolving such issues can eliminate unexpected financial burdens.

- Building code violations: Breaches in building codes can affect commercial property transactions, so it’s best to do comprehensive due diligence before finalizing the agreement.

The Benefits of Commercial Title Insurance

Purchasing commercial title insurance has many benefits for your business.

1. Financial Protection

The primary advantage of commercial title insurance is its protection to property owners. Although a thorough investigation may be conducted when purchasing a commercial property, some title defects are latent. Here are three common examples:

- Undisclosed heirs: There are instances where unknown family members make claims to properties. Classic examples include the assertion of gift or inheritance, especially when the original owner died intestate, or without a will. These claims may result in lawsuits, which can cause you to incur financial losses.

- Conflicting wills: Wills are designed to facilitate a smooth transition of assets but can sometimes cause title disputes. This is particularly true when the testator — the person making the will — executes multiple conflicting wills. In other cases, the validity of a will may be challenged, which, if proven, can affect your ownership of the property.

- Fraud and forgery: Detecting fraudulent transactions is sometimes challenging, even after thorough due diligence. Title insurance can protect you in such situations, providing a safety net against unexpected losses.

Commercial title insurance also protects lenders against financial losses. It covers the collateral lien placed on the mortgage, protecting the lender’s security interest in the property.

2. Good Title

Before getting commercial title insurance, a thorough search is conducted into the ownership of the property. This process can reveal title defects or undisclosed interests, helping you to establish a good title. Due diligence also mitigates the risk of disputes.

In the event of a lawsuit, the due diligence conducted as part of the commercial title insurance processes can be used as a legal defense. For example, the purchaser of the commercial property may assert to be a bona fide purchaser for value without notice. A bona fide purchaser is a person who takes title to property without actual or constructive knowledge of any claim to the property after making reasonable inquiry.

3. Smooth Transaction

Before issuing a policy, the insurance or settlement company extensively searches the property’s ownership. Doing so helps uncover potential issues like encumbrances, liens and conflicting interests. It also offers the opportunity to rectify defects, ensuring the buyer gets a marketable interest in the property.

By identifying and addressing these potential issues, the parties gain confidence in the transaction and are likely to close earlier. It often makes the processes seamless and eliminates unnecessary delays, surprises and complications. Parties can negotiate with clarity and certainty, especially when time is of the essence.

4. Peace of Mind

Knowing you are protected when investing in a commercial property is a relief. Commercial property insurance provides that much-needed safety net, allowing you to enjoy the property with less worry on your shoulders. The insurance company assumes responsibility for future title issues subject to the terms of the agreement, allowing you to focus on growing your business.

Besides the financial safeguard, commercial title insurance reduces the risk of disputes. As a business owner, having fewer legal challenges helps with anxiety. It eliminates emotional stress and lets you plan your business for future generations.

What Does Commercial Title Insurance Cover?

Here are examples of coverage you get from commercial title insurance:

- Title defects, including incorrect deeds, fraud and forgery

- Competitive claims

- Undisclosed liens, such as unpaid contractor invoices, mortgages and taxes

- Boundary disputes

- Encumbrances like easements

- Errors in public records

What Does Commercial Title Insurance Not Cover?

Commercial title insurance does not typically cover the following:

- Title defects created after signing the policy

- Building code violations after signing the policy

- Liens created by new property owner

- Non-compliance with laws on behalf of the new owner

How to Get Title Insurance for a Commercial Property

Here is the step-by-step process for getting commercial title insurance:

1. Research Title Insurance Companies

There are different ways to get commercial title insurance in Pennsylvania. The first is contacting an insurance company directly. The second is working with settlement agents. Each has its benefits, but checking the company’s track record, experience and customer relations is essential before making a decision.

Title agents or attorneys with insight into real estate transactions can guide you in helping you get the ideal coverage. They can conduct the necessary research and coordinate with reliable insurance companies on your behalf.

2. Provide Property Information

The insurance company or title agency will typically inquire about the property and ask you to submit certain documents regarding the property address, description, purchase agreements and mortgage. It’s essential to be transparent and honest to enable the insurer to conduct proper due diligence.

3. Conduct Title Search

The title agent or attorney working with the insurance company will search the property’s history to identify possible defects. This process will include examining public records, surveys, deeds, identification documents and other relevant information.

If the agent or attorney discovers title defects, they will try to resolve them. The resolution may involve getting further documentation to establish a clear title, clearing outstanding liens or addressing ownership issues.

4. Review the Commercial Title Insurance Policy

The insurance company will issue a title insurance policy once the title search and defect resolution are complete. The policy will provide the terms of the coverage, including the amount and exclusions. It’s essential to review the agreement carefully before you sign it. If you have any questions, consult the attorney for an explanation.

5. Pay the Premium

The commercial title insurance premium is usually a one-time payment. The amount will depend on factors like the property’s value. Additional fees may include expenses incurred during the title search and professional services, typically paid at closing or settlement.

The Advantages of Working With a Commercial Land Title Insurance Company

Working with a reliable commercial title insurance attorney comes with many advantages.

- Knowledge and experience: Settlement agents and real estate attorneys understand the nuances of commercial property acquisitions. They also have experience addressing complex issues that typically arise during settlement. Real estate attorneys can conduct detailed investigations and provide tailored advice.

- Professionalism: Real estate attorneys are supervised by regulatory bodies and are required to uphold high ethical standards, ensuring professionalism.

- Thorough examination: Real estate attorneys are effective at risk assessment and management. They can anticipate potential defects and implement strategies to resolve them, which saves you money and time.

- Efficient claim resolution: If undetected title issues arise, real estate attorneys can help you resolve them. They have experience in dispute resolution and possess the resources to achieve the best possible outcome. Plus, they can work with the insurance company to activate your protection under the coverage if you have a valid claim.

Factors to Consider When Choosing a Commercial Title Insurance Company

Here are four vital points to consider when choosing a commercial title insurance company in Pennsylvania:

- Experience: Select a company with a good track record of underwriting title insurance for businesses. They should also understand your needs and be capable of offering personalized services.

- Coverage: Compare the insurer’s coverages and exclusions with others before making a decision. The goal is to sign a contract that offers sufficient protection.

- Pricing: When it comes to title insurance, the cheapest option is not always the best. Instead, consider factors like return on investment when searching for a partner.

- Customer service: Check whether the estate attorney has excellent client relationships — testimonials speak volumes about their credibility and professionalism. Select a company that is responsive and available to provide the needed support.

How Much Does It Cost to Get Commercial Title Insurance?

The cost of commercial title insurance varies from case to case. It depends on factors like the insurance premium, title search cost, professional fees and miscellaneous expenses like recording fees, settlement fees and deed preparation. Factors that influence the insurance premium include:

- Price of the property

- Loan amount

- Location of the property

- Condition of the property

- Property history

Is commercial title insurance more expensive than residential title insurance? Considering that commercial properties are generally larger, they’re more likely to cost more. The most important thing is partnering with a reliable real estate attorney and insurance company with the experience to deliver the best possible results.

Contact MPL Law Firm Today

MPL Law firm underwrites commercial title insurance for Stewart Title and Guarantee Company through our licensed settlement company, MPL LandServices, LLC. We provide full-service representation for escrow services and real estate closings.

Our professional team is supportive, honest and transparent, aiming to offer cost-effective yet efficient services to clients and striving to form long-lasting relationships. If you want to ensure a smooth transaction when purchasing or selling your commercial real estate property, contact us now.

Learn More About General Counsel Corner:

Home Title Insurance: The Complete Guide for Homeowners

What is home title insurance? What are the benefits of getting title insurance when buying a residential property? Are there any tips for choosing the ideal insurance provider? If yes, what are they?

Most residential property buyers and sellers in Pennsylvania find the concept of home title insurance confusing, which is understandable. Title insurance is a unique coverage with features different from a typical insurance policy. However, it’s arguably the most important protection for homeowners, considering the possibility of losing the property or incurring outrageous financial losses.

What Is Home Title Insurance?

Home title insurance is a unique insurance coverage designed to protect home purchasers or lenders against financial losses arising from title defects. Title insurance also mitigates the risk of title disputes, unlike other insurance coverages, which typically assume risks.

The insurer or settlement company conducts an extensive search into the ownership of the property to identify and rectify any flaws associated with the property’s title. If any defect goes undetected, which later results in a dispute or claim, the insurance company will assume the financial loss, subject to the terms of the agreement.

Home title insurance may be optional or mandatory, depending on how you purchase the property. Typically, title insurance is compulsory for home purchases secured by a mortgage. It’s usually optional if you pay cash for the property.

There are many benefits of home title insurance. Primarily, the coverage protects the policyholder against financial losses from a defective title and provides some assurance that the homeowner is acquiring a good title. It also facilitates smooth transactions and gives you the peace of mind to enjoy the property. We’ll discuss these in detail later.

Types of Home Title Insurance

There are two main types of home title insurance:

- Owner’s title insurance policy: Protects the home purchaser against financial losses from title defects. Common risks include conflicting ownership claims, undisclosed heirs, pending lawsuits, fraud or forgery, liens, and encumbrances. An owner’s title insurance policy is usually optional when purchasing the property by any means other than a mortgage, but it is recommended to protect yourself against adverse claims.

- Lender’s title insurance policy: Protects the lender by providing some level of reassurance regarding the validity, priority and enforceability of its mortgage or lien. The lender’s title insurance is typically mandatory for real estate purchases secured by a mortgage.

Title Insurance vs. Homeowners Insurance

Home title insurance and homeowners insurance are insurance coverages with apparent differences. Here are four examples:

- Scope of protection: Title insurance protects you against financial losses arising from a defective title, while homeowners insurance protects you against perils like property damage, theft, personal injuries on the property and loss of use, which involves the living expenses you incur if your home becomes inhabitable.

- Period of protection: Title insurance is retrospective, protecting you against title defects that occurred before you purchased your home. Homeowners insurance is prospective. It protects you against losses that occur after you buy the property.

- Risk perception: Title insurance seeks to eliminate the risks of title defects, while homeowners insurance mostly assumes the risks. Title examiners conduct a title search to identify and resolve defects before issuing home title insurance.

- Premium payment: The home title insurance premium is a one-time payment. The homeowners insurance premium is continuous and could be paid monthly, quarterly or annually, depending on the contract terms.

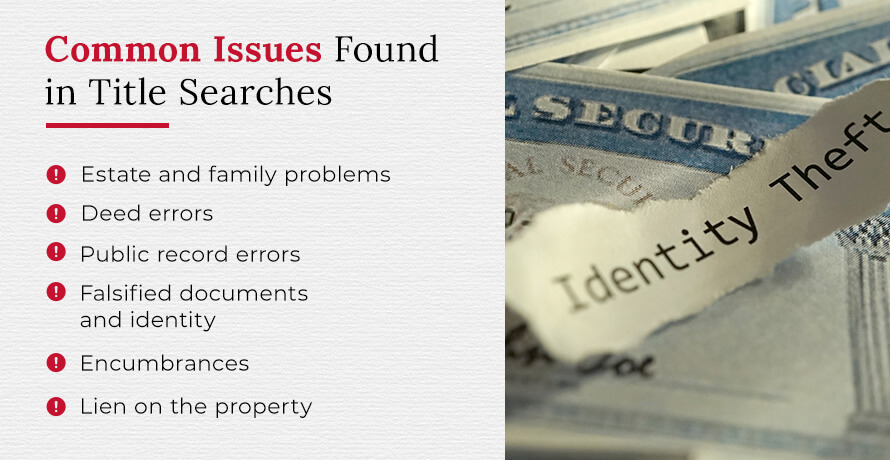

Common Issues Found in Title Searches

Here are some common issues that real estate attorneys and title examiners find during title searches:

- Estate and family problems: There are many variations of estate and family problems you may uncover during the title search, but the common examples include undisclosed heirs and conflicting wills. These unresolved issues can affect the seller’s right to transfer title and thus must be resolved appropriately.

- Deed errors: Generally, a property owner can only give what they have, meaning they can only transfer what they are entitled to. These rights are often captured in the real estate deed. However, there may be errors in the document, such as the property’s description or interest, leading to disputes and potential lawsuits.

- Public record errors: Title searches can reveal clerical errors or omissions affecting the validity of the title or nature of interests. Real estate attorneys can help you resolve these defects before closing the sale.

- Falsified documents and identity: In an attempt to defraud, some people forge or conceal documents related to the property. Others also impersonate the actual owner by creating fake identification documents. Considering that such people have no rights or interests in the property, any transaction made will generally be void.

- Encumbrances: These are rights, other than ownership interests, affecting a real estate property. Examples of encumbrances are easements and restrictive covenants, which can interfere with your use of the property.

- Lien on the property: Lien is the right of a person — typically a creditor — to assert rights over a property due to an undischarged obligation. The lienholder can apply to the court to seize and sell your property unless the debt is paid. There are different types of liens, including mechanic’s liens, mortgages and tax liens.

Is Home Title Insurance Necessary? 4 Benefits of Home Title Insurance

Home title insurance has many benefits, including those listed below.

1. Offers Financial Protection

The primary advantage of purchasing a home title insurance policy is the protection it offers. Although the title examiners investigate the property’s ownership before issuing the coverage, there are instances where some defects go undetected, and that’s when title insurance kicks in. The insurance company generally takes responsibility for any financial losses you incur according to the terms of the agreement, including litigation and settlement costs.

2. Helps Establish Good Title

An integral part of the home title insurance process is the title search, where title examiners or attorneys investigate the property’s ownership to identify and rectify title defects. This helps determine whether the seller has a good title and has legal rights to transfer the same to another person. Additionally, it can reveal the type of interest or right the seller has in the property, enabling buyers to make an informed decision.

Due diligence mitigates the risk of disputes and can also assist in establishing a defense against future claims. For example, if previously undiscovered back taxes were owed on the property a new owner purchased, an owner’s title insurance policy would likely cover those taxes. If the new owner did not purchase title insurance, they would either have to pay those back taxes out of pocket or risk losing their new home.

3. Facilitates a Smooth Transaction

Knowing that the seller has marketable title to the property and the right to convey or transfer the same gives the parties confidence to close the transaction. The title search can uncover potential issues like conflicting interests and encumbrances, helping the buyer make an informed decision. It eliminates unnecessary delays, surprises and complications during negotiation.

4. Gives Peace of Mind

Title insurance offers the safety net you need to enjoy your new home. It can protect you against financial losses and mitigate the risk of lawsuits. A good title search can also serve as a solid legal defense in the event a dispute arises, reducing the chances of you losing your home. These safeguards offer relief, especially now that forgery or fraud schemes are so realistic.

What Does Home Title Insurance Cover?

Home title insurance generally covers defects resulting from the following:

- Competing claims

- Undisclosed encumbrances and liens

- Undiscovered wills

- Missing heirs

- Fraud or forgeries

- Deed errors or omissions

- Public record errors or omissions

- Boundary and survey disputes

What Does Home Title Insurance Not Cover?

Home title insurance does not typically cover the following:

- Title defects created after signing the insurance policy

- Known defects

- Liens created by the new property owner

- Building code violations after signing the insurance policy

- Noncompliance with laws

Typical Terms and Conditions of Home Title Insurance

The standard terms and conditions of home title insurance include the following:

- Coverage: The insurance company may be responsible for specific risks and issues, like public record errors and omissions or undisclosed liens. Reviewing this section is vital because it tells you what you are protected against.

- Exclusions: This is a list of events and circumstances excluded from coverage. Classic examples include known defects and regulatory breaches.

- Premium: The premium is the amount you pay for the coverage. A home title insurance premium is a one-time payment, typically determined by the property’s value and condition.

- Policy limits: Policy limits describe the maximum amount you can claim under the home title insurance coverage. Policy limits often determine the premium required.

- Notice of claim: This is the process and timeframe for reporting claims to the insurance company.

- Loss of mitigation: The policyholder has an obligation to take reasonable steps to mitigate potential losses arising from the covered issues. For example, the policyholder may be required to notify the insurer promptly after receiving notice of an adverse claim.

The title insurance contract is a legally enforceable agreement, so reviewing it carefully before you sign is essential. It details your rights, obligations and liabilities, which may vary depending on the circumstances. It’s best to consult a reliable and trusted attorney with any doubts or questions.

How Much Does Home Title Insurance Cost?

The cost of home title insurance varies from case to case, depending on factors like:

- Property value: Generally, the more expensive the property, the higher the premium you will pay. The value of the house is determined by its size, overall condition and location.

- Property history: The property’s history impacts the level of search required and the potential risks involved. For example, title insurance for a house belonging to a large family with multiple mortgages will typically cost more, considering the extent of title search required and possible risks associated with the title.

- Professional and miscellaneous fees: Fees paid to professionals like attorneys and surveyors will influence the cost of your home title insurance. You may also incur expenses on things like filing and search reports.

- Extended coverage: You can get additional protection beyond the standard coverage for an extra fee. A good example is getting extended coverage to cater to situations where your property’s value increases.

How to Get Home Title Insurance

Now that you know what home title insurance is and the protection you get from purchasing coverage, let’s look at how you can get one to protect your investment.

1. Research a Title Insurance Company

There are many title insurance companies, so it helps to do detailed research. One of the best ways is working with a reliable title settlement agent or attorney since they have connections with some of the best insurance companies. Prioritize those providing full-service representation for escrow services and real estate closings. Doing so eliminates unnecessary costs while ensuring you get efficient services.

2. Provide the Necessary Information

The title insurance professional will require you to submit some documents, such as a copy of the deed, purchase agreement and mortgage documents, if any. It’s best to be transparent with the title insurance company and submit the documents timely to facilitate the results. The real estate attorney may contact the vendor directly on your behalf if they require further information or clarification.

3. Conduct a Title Search

The title search is one of the most critical stages. This is where the title examiner investigates the property’s ownership history for consistency. The examiner reviews existing deeds, surveys, public records and identification documents before concluding. If they uncover any defects, they will try to resolve them by asking for clarifications or further documentation to establish a clear title. The title examiner may also recommend the payment of existing debts.

4. Review the Commercial Title Insurance Policy

Once the title examiner is satisfied that the title is free from defects, the insurer will provide you with the contract detailing your rights, liabilities and obligations. You can consult the attorney for clarifications if you are working with a full-service firm. Otherwise, you can seek external legal advice for an additional fee.

5. Pay the Premium and Sign the Contract

You can pay the one-time premium after reviewing the terms and conditions. There may be other administrative and professional fees depending on the circumstances. Sign and submit the contract to the settlement agent or insurance company to complete the process.

Selecting the Right Home Title Insurance Company

There are four title factors to consider when choosing the ideal home title insurance company to partner with. These are:

- Experience and professionalism: Check the company’s track record in underwriting title insurance for homeowners. Experienced professionals can assess your needs and provide the ideal coverage.

- Coverage: Review the coverage and exclusions before making a decision. Aim at getting sufficient coverage for a reasonable price.

- Pricing: The cheapest option is not always the best for home title insurance. Instead, focus on whether the policy adequately addresses potential pitfalls that could affect your home’s title. A helpful strategy is selecting a firm that provides full-service representation for escrow services and real estate closings.

- Customer service: Examine the real estate attorney’s customer relations when searching for the ideal partner. Relation-based firms offer added value beyond the core services.

Why Trust Us for Title Insurance Information?

MPL Law Firm has decades of experience across practices, including title insurance. We base our title insurance information on the practical experience that our legal team has garnered. Many of our team members — including Charles A. Rausch, Christian R. Miller, John D. Miller, Jr. and John J. Baranski, Jr. — focus on title insurance law and are licensed agents. Their experience drives our ability to provide accurate legal information and insightful guidance.

Beyond our experience with title insurance, we also exhibit a unique commitment to homeowners in Pennsylvania. MPL Law has operated out of Central Pennsylvania since our foundation in 1987 as Miller & Poole. Since then, we’ve dedicated ourselves to helping Pennsylvania homeowners understand and carry out the legal options available to them. We exemplify our commitment to your community by providing rigorous legal support and actionable real estate insight tailored to your goals.

MPL Law Firm: Your Trusted Home Title Insurance Professional

Choosing an experienced title insurance professional comes with many advantages. They can perform effective title searches and find practical solutions to curing defects. Title settlement attorneys also have the experience to provide tailored advice.

At MPL Law, we have extensive experience providing real estate transactional services. Our licensed settlement company, MPL Land Services, LLC, underwrites home title insurance for Stewart Title and Guarantee Company. We strive to understand our client’s needs and offer the most ideal coverage. Contact us today to learn more about our services!

Learn More About General Counsel Corner:

Understanding Title Settlement Fees

Title settlement fees have many components, and learning what they entail before you sign any binding agreement is essential. Title settlement is necessary for those buying residential and commercial real estate properties with or without a mortgage. It’s also vital when getting title insurance. Below, we discuss the possible expenses you may incur and how you can negotiate to save money.

What Is a Title Settlement Fee?

Title settlement fees are the administrative expenses associated with closing real estate transactions. It’s the money you pay to the title company to streamline the purchase and sale process and ensure the transfer of a good title. Title companies perform several beneficial functions, especially for those getting title insurance:

- Collecting and preparing legal documents such as title documents, deeds and transfer forms.

- Pairing the parties with the ideal title insurance company.

- Conducting the title search to identify and resolve defects.

- Advising parties on legal issues.

- Recording the deed transfer and mortgage documents.

- Witnessing and notarizing documents.

- Coordinating meetings.

- Collecting and disbursing funds to all parties.

- Preparing and distributing the completed closing packages.

Who Pays the Title Settlement Fee?

The buyer typically pays the title settlement fees as part of their closing costs. A common exception is a transaction involving a lender, where the buyer and seller may split the payment. It’s also possible for the parties to decide who pays, regardless of the usual expectation. For example, the parties can negotiate that the seller pays the title fees as part of seller concessions.

Seller concessions are the closing costs the seller agrees to pay. It can be complete or partial depending on the contract and generally covers the following:

- Title insurance: Protects the buyer or lender against financial losses resulting from issues with the property title.

- Loan origination fee: The fees lenders charge for processing loans.

- Appraisal fee: The expense you incur by getting a licensed third-party appraisal to determine the property’s market value.

- Recording fee: Covers expenses related to documenting the purchase at the local registry.

- Attorney fee: Covers the cost of hiring a real estate attorney.

Seller concession makes the property attractive to potential buyers. However, it’s essential to understand that sellers can only pay a limited amount, so the buyer must negotiate carefully.

How Much Is a Title Settlement Fee?

The cost of title settlement varies from case to case, depending on factors like the title search, escrow, closing and professional fees. Let’s dive deeper to see what each covers:

- Title search: Covers costs you incur on things like surveys, search reports, abstract of title and other administrative expenses.

- Escrow fees: The expenses you incur for having an escrow agent, attorney or title company to hold and distribute monies pertaining to the real estate transaction at closing.

- Closing fees: The expenses you may incur at the end of the real estate transaction. They may include administrative costs for title insurance or settlement services.

- Professional Services: The money you pay to professionals like real estate attorneys, notaries and surveyors. Attorneys’ fees, for example, may cater to deed preparation, title searches and legal advice.

- Miscellaneous: Covers related expenses like application and recording fees.

What Are the Different Categories of Title Insurance Costs?

There are two different categories of title insurance fees you should understand.

1. Owner’s Title Insurance

The coverage protects the property buyer against financial losses arising from an undetected title defect, such as:

- Estate and family issues: Title insurance can protect you against many estate and family issues arising from divorces, undisclosed heirs and conflicting wills.

- Deed errors: Errors in deed instruments can interfere with the owner’s rights and interests, making it essential to purchase title insurance.

- Encumbrances: A person’s right — other than ownership interests — affects the property. Examples include easements and restrictive covenants. An easement is the right of another person to use your land, while a restrictive covenant is a clause in the conveyance that prohibits or restricts you from using the property in a certain way.

- Liens: A lien is the right of a person — typically a creditor — to assert claims against a property due to an undischarged obligation. The lienholder can apply to a court to seize and sell your property unless the debt is paid. There are different types of liens, including mechanics, tax and mortgage liens.

- Falsified documents and identification: Fraud and forgery through impersonation, creation of fake documents or any other deceptive means can invalidate the transaction, so it’s best to get title insurance for added protection.

Owner’s title insurance is optional but crucial, considering the protection it offers. Besides providing coverage for possible title defects, it also tries to mitigate the risk altogether.

2. Lender’s Title Insurance

The coverage protects lenders against adverse claims on the property. It’s mandatory for real estate properties secured by a mortgage and safeguards the lender’s mortgage or lien in terms of its priority, validity and enforceability.

You can purchase lender’s title insurance in a bundle with owner’s title insurance, typically for less. It’s a one-time premium like owner’s title insurance and is charged as a percentage of the sale price. The lender’s title insurance covers the life of your loan, so you may need to purchase a new coverage if you refinance.

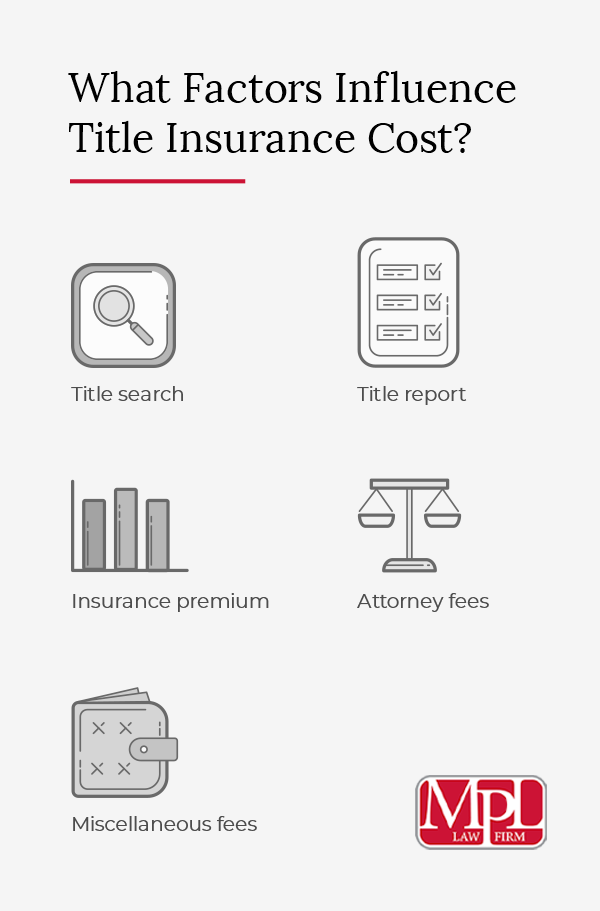

What Factors Influence Title Insurance Cost?

The cost of title insurance has several components:

- Title search: The cost of the examination conducted to ascertain whether the seller’s title to the property and the right to convey same to the buyer.

- Title report: The cost of the documented outcome of the search report providing information such as the current owner, property description and encumbrances.

- Insurance premium: The one-time premium paid at closing.

- Attorney fees: Costs for the attorney services, search as title examination and preparation of legal documents.

- Miscellaneous fees: Associated expenses such as settlement and filing fees.

The premium you pay for title insurance also varies from case to case and is influenced by the following:

- Property value: Different factors affect property value, including the location, size and overall condition. High-valued properties typically attract high premiums, considering the risk value.

- Property type: Commercial properties usually attract higher premiums since they often cost more. However, there are instances where residential real estate properties have higher values.

- Property history: The amount of work necessary to obtain accurate information and the potential risk associated with the property can determine your premium. Properties with clean, consistent title histories often attract lower premiums.

- Extended coverage: Purchasing additional protection beyond the standard coverage increases the insurance premium. A classic example is when you get extended coverage to cater to increased property value.

What Is a Loan Estimate?

A loan estimate is a standardized form providing necessary financial information about the mortgage, including the estimated interest rate, closing costs and monthly payment. It helps the borrower know what to expect going into the loan agreement with the lender.

Previously, the lender was required to provide two documents — the Truth-in-Lending Act statement (TILA) and the good faith estimate (GFE). TILA contained the written disclosures, while GFE provided basic information about the terms of the mortgage loan offer. These two documents are now combined into one to form the loan estimate.

A standard loan estimate contains the following information:

- Loan terms: Includes information like the loan amount, interest rate, repayment penalty and balloon payment. Remember, these details are only relevant for properties secured by a mortgage.

- Projected payments: The total amounts covering things like the principal and interest, estimated escrow, and mortgage insurance.

- Loan costs: The administrative costs the borrower incurs on things like application, underwriting, credit reports and title-related services.

- Closing costs: A percentage of the purchase price or loan amount charged for closing the transaction. The amount you pay depends on the type of loan and its purpose.

- Other costs: Associated costs like taxes and other government fees, initial closing escrow payment and any prepaid items.

It’s vital to remember that the loan estimate is not the same as a loan approval. It estimates what the borrower should expect going into the loan agreement, which can change depending on the situation. The document provides other essential information, such as the name and address of the loan applicant, the date issued, the property address and the sale price.

What Is the Impact of Title Settlement Fees on Buyers and Sellers?

Title settlement fees bring additional costs to buyers while reducing sellers’ net proceeds. However, considering how crucial title settlement is in the property acquisition process, it helps both parties to prepare and plan ahead of time.

A practical solution is partnering with a full-service title settlement company with experience closing residential and commercial real estate transactions. This way, you can lower costs while getting efficient and comprehensive services. The parties must also negotiate and share the cost-effectively to balance their financial responsibilities. The interest of both parties is to streamline and facilitate closing, so it’s best to collaborate.

Work closely with your real estate attorney or settlement agency to understand the specific settlement fees you may incur and those you can trade to help close the transaction. Additionally, carefully review the closing statement, loan estimate and other documents before signing. You want to ensure the information is accurate and the costs are correctly apportioned before concluding.

Can You Negotiate Title Insurance and Settlement Fees?

Some aspects of the title insurance and settlement fees are negotiable, while others are typically non-negotiable. Knowing the difference can help you cut down costs.

1. Negotiable Fees

These are the negotiable title insurance and settlement fees:

- Origination fees: Covers the cost of underwriting the loan. The origination fee is a percentage of the loan amount, but you can negotiate for a reduction or complete elimination.

- Discount points: The upfront fee for a reduced interest rate on your mortgage loan. It’s calculated as a percentage of the total loan amount.

- Title search fee: The cost you incur on the title search before getting title insurance. The examination helps you identify title defects on the property.

- Title insurance premium: The one-time premium paid to the insurance company at closing. The amount is negotiable, but ensure adequate coverage to safeguard your interest.

- Underwriting fees: The amount you pay the underwriter for verifying your income, assets, debts and property details before approving the loan. The lender may replace this with the origination fees, but you can negotiate to reduce the amount.

- Real estate commissions: The commission paid to real estate agents for their services. The seller is usually responsible for paying the fee but can negotiate to reduce the amount.

- Loan application: The one-time fee paid to the lender for processing and underwriting the loan. You can negotiate with the lender, especially when making other substantial payments.

2. Non-Negotiable Fees

Below are the fees that are typically non-negotiable in title insurance and settlement transactions:

- Appraisal fees: The money you pay for having an appraiser evaluate the property to determine its fair market value. The buyer typically pays this fee.

- Credit check fees: The costs associated with credit checks before the lender issues or approves the loan. It helps the lender determine the rate and repayment terms. Although it’s typically non-negotiable, lenders sometimes cover the fee themselves.

- Government charges: The money you pay to the government to cover things like title transfer and filing. Government charges also include property taxes.

Tips for Effective Negotiation

Negotiating with the buyer, seller, lender, settlement company or insurer is necessary to gain a financial advantage. It’s a skill learned through practice and experience, but the following tips can help you succeed:

1. Prepare

Always prepare before going into a negotiation. Research the other parties and identify areas where you can cut costs. Again, always set your best alternative to a negotiated agreement (BATNA) or worst alternative to a negotiated agreement (WATNA) beforehand. The BATNA is the most advantageous alternative you can take if negotiations fail, while the WATNA is the worst possible result you would take if negotiations fail.

2. Listen Carefully

Resist the urge to interrupt the other party while they’re talking. Remain calm and allow them to share their opinions. This approach will enable you to determine what’s most important to them and what they’re willing to compromise. Listening carefully lets you ask the right questions and establish a lasting bond with your counterpart.

3. Work With the Parties

Work with the parties to find a favorable outcome. Remember, each party wants their interests protected, so you must collaborate to find a practical solution. Use your leverage wisely and be respectful throughout the process.

You can compare prices to gain a good understanding of the market and help you make an informed decision. Finally, prioritize the most critical expenses and use them to negotiate seller concessions. Making smart tradeoffs will enable you to get value for your money.

4. Leverage Other Professional Services

You can consider full-service title settlement companies and negotiate to get multiple services for a reasonable fee. For example, if the settlement company is a real estate law firm, they may conduct the title search, underwrite the loan, prepare the necessary documents and provide legal advice, which is more beneficial than hiring different companies for each process.

MPL Law Firm Is Your Trusted Real Estate Professional

MPL Law Firm is a full-service, relationship-based real estate transactional firm in York, Pennsylvania. We underwrite home title insurance for Stewart Title and Guarantee Company through our licensed settlement company, MPL LandServices, LLC.

We are dedicated to understanding our clients’ needs and helping them streamline the settlement process. If you want to learn about our services, contact us now.

Learn More About General Counsel Corner:

The Devil is in the details – Due Diligence

The letter of intent is signed and now you want to look more into the deal. What does that mean? If you are the Buyer, do you just ask the Seller if business is going well and leave it at that? Probably not unless you have some sort of magical insight. Due diligence is one of the most important parts of the whole buy/sell process. Why? It’s where you validate your assumptions or answer your questions about the business. Below are some of the due diligence items that are most often reviewed:

- Financial

- Income Statements, balance sheets and cash flow

- Tax Returns

- Inventory

- Asset List

- Bank records and reconciliation

- Legal

- Organizational documents

- State certificates of authority

- Litigation

- Insurance

- Agreements

- Intellectual property

- Licenses/permits/regulatory approvals

- Operations

- Key vendors

- Customer lists

- Marketing

- Employee

- List of employees

- Payroll info

- Handbooks

- Benefit plans

- Employee contracts

- IT

- Website/social media/email

- Software

- Hardware

- Environmental/Regulatory Issues

All of this should be ready to provide if you are the Seller and thoroughly reviewed if you are the Buyer. The proverbial “devil is in the details” comes out in this phase. Make sure you have a solid team of business advisors to help you through this process.

Here are some other items of interest:

- What Can Negatively Impact Your Chances of a Sale? (thenybbgroup.com)

- What You Need to Know About the Confidential Business Review (thenybbgroup.com)

As always, please don’t hesitate to email myself (jsanders@mpl-law.com), Andy Miller (amiller@mpl-law.com), Christian Miller (cmiller@mpl-law.com), Erik Spurlin (espurlin@mpl-law.com), Brad Leber (bleber@mpl-law.com) or anyone in our office with questions or comments.

Please see all of our prior updates at this link or if you would like to be added to our email list, please click here.